I apologize for the profanity in yesterday’s post. I had a very bad day and took it out on the market. When in reality I really don’t care about the stock market in whatever way it goes. Sometimes you get “yanked about” in life circumstances and the market has been behaving this way over many weeks. In the end, the market is all in God’s plan so why would I fight it?

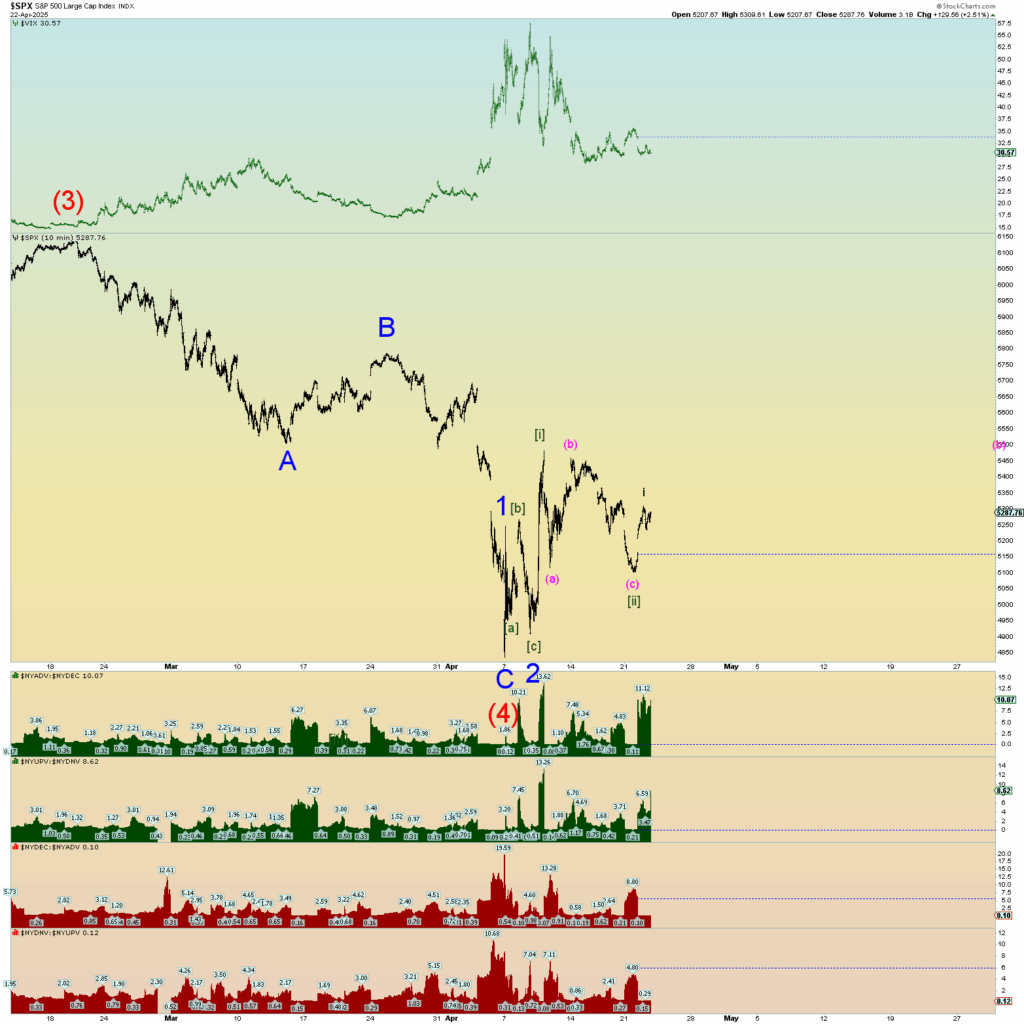

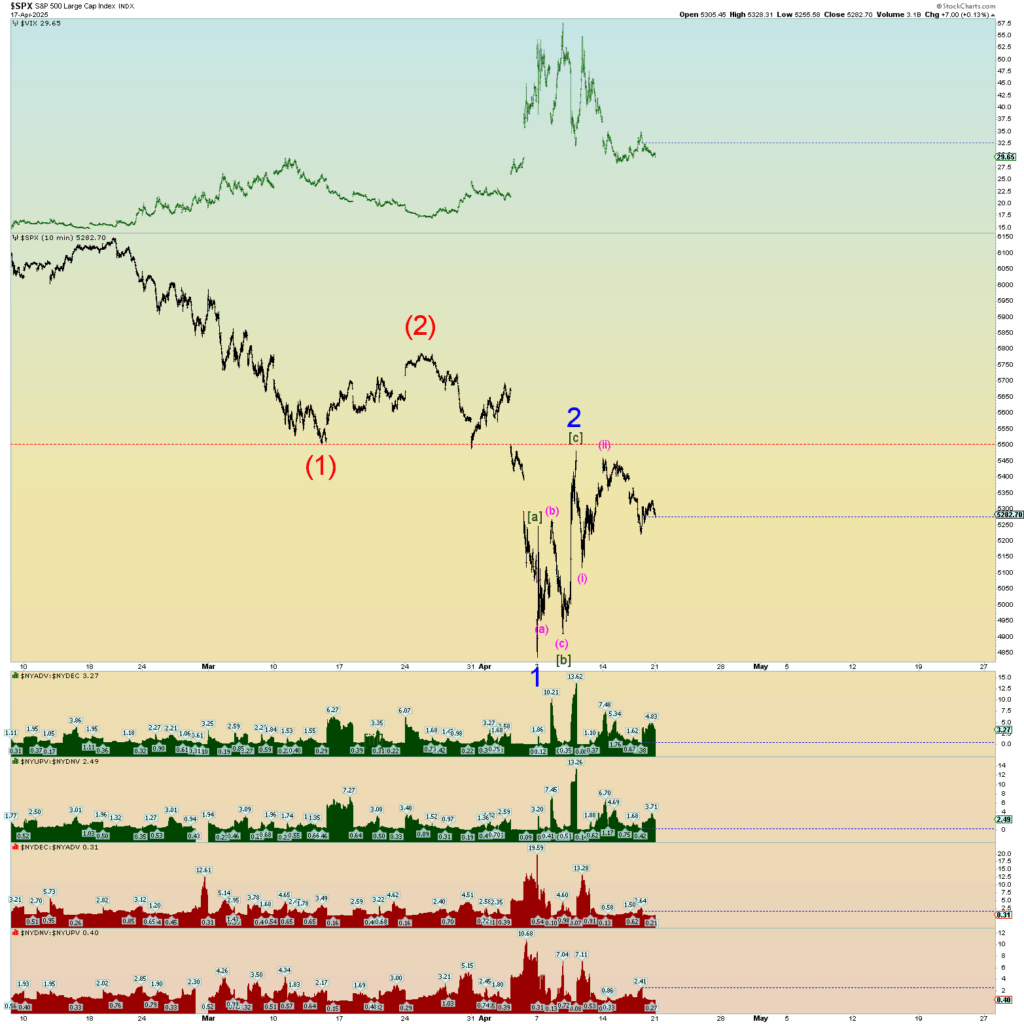

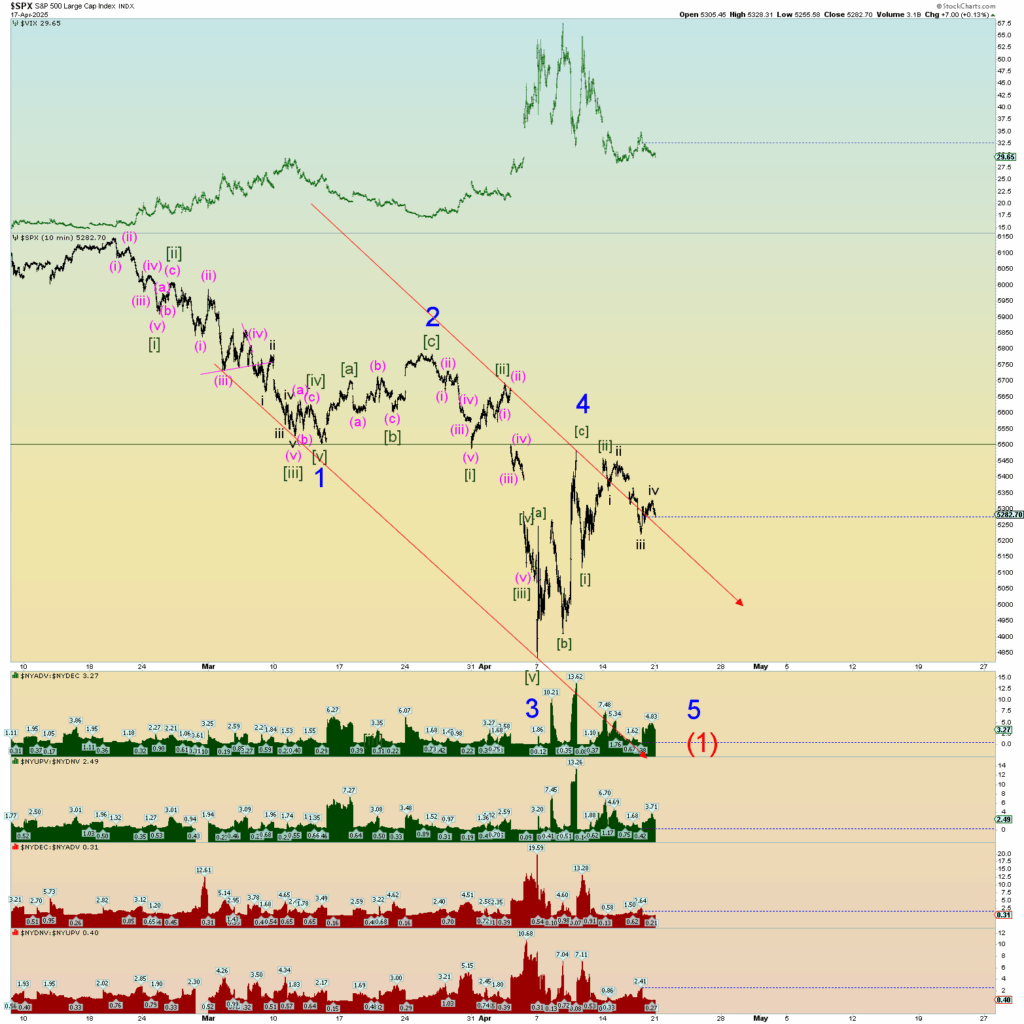

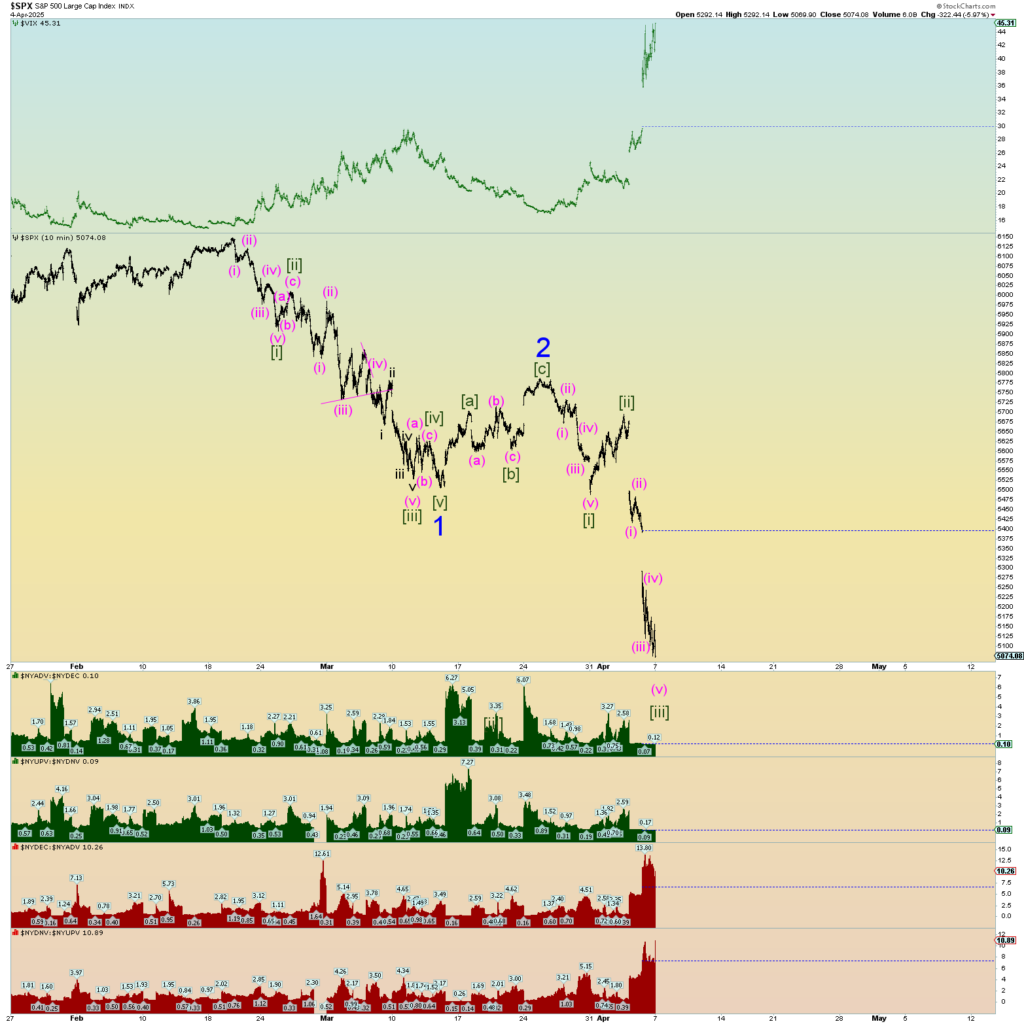

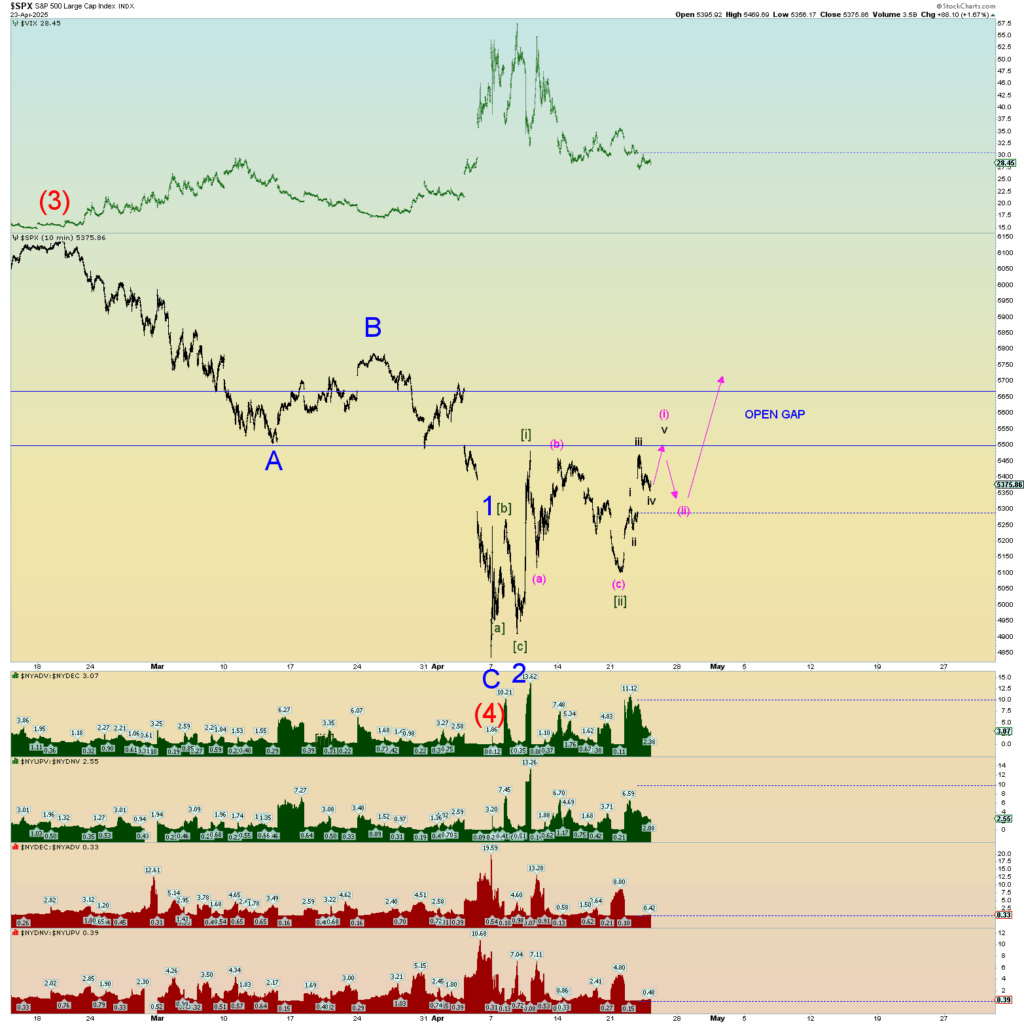

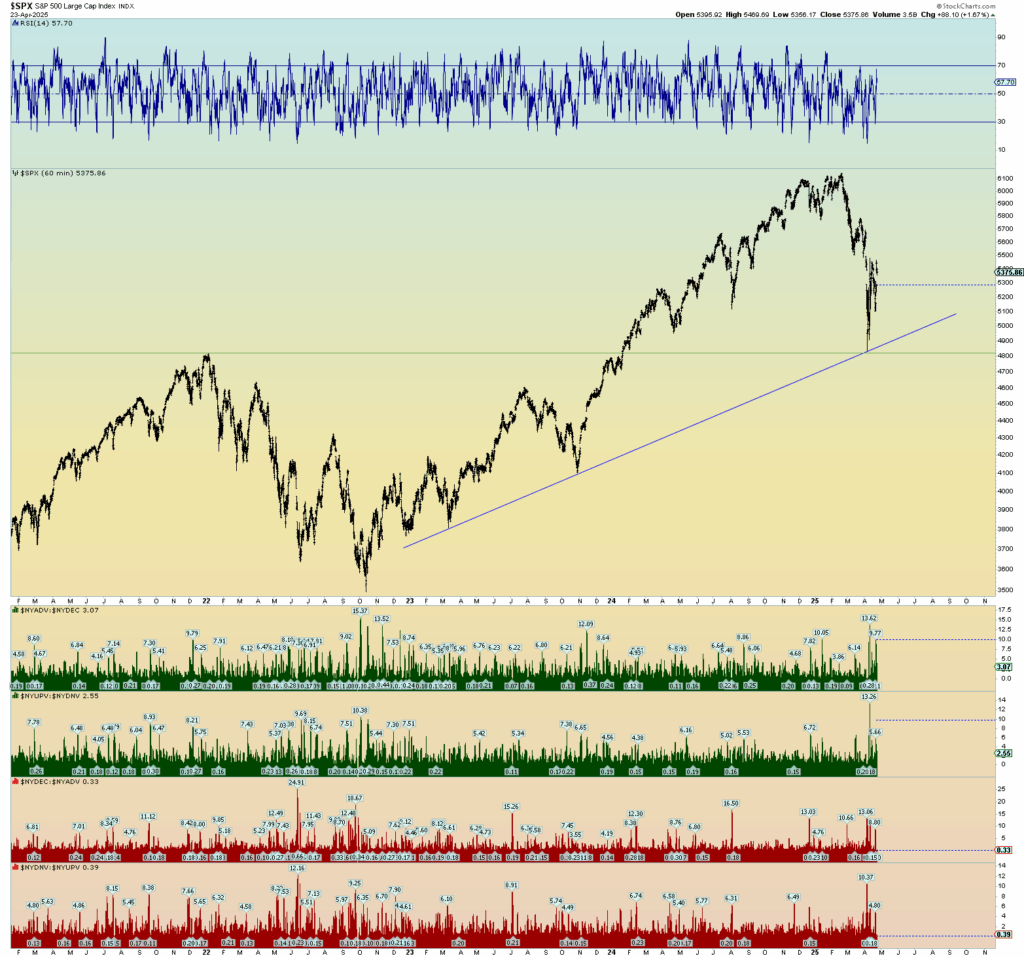

Today is a day that took out the most recent high but not the second most recent high. A very obvious triple short-term top in the market has now occurred. The massive 167-point open chart gap down is such a strong market target. When it opened down massively a few weeks ago, I suggested that the market likes to challenge these gaps sooner rather than later. Well, the market plunged and immediately historically bounced, and it has been clawing and heaving doing its best to breach that massive gap down. And so we have reached a stage where it may be in a position to finally do so.

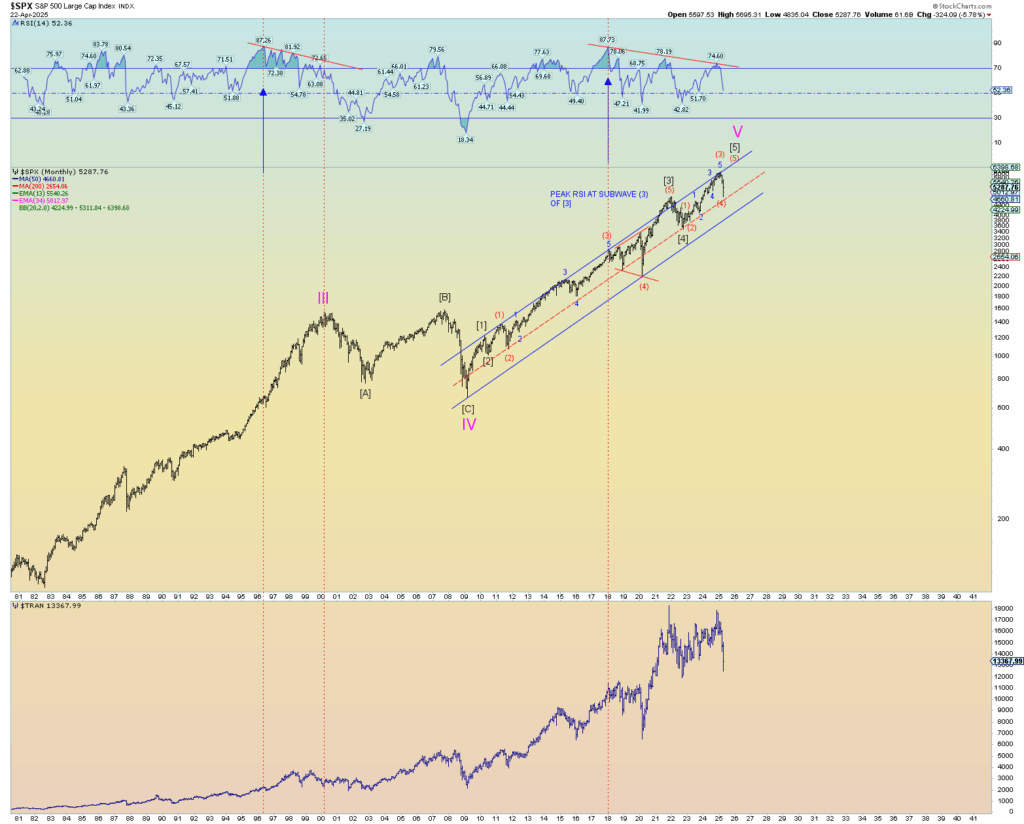

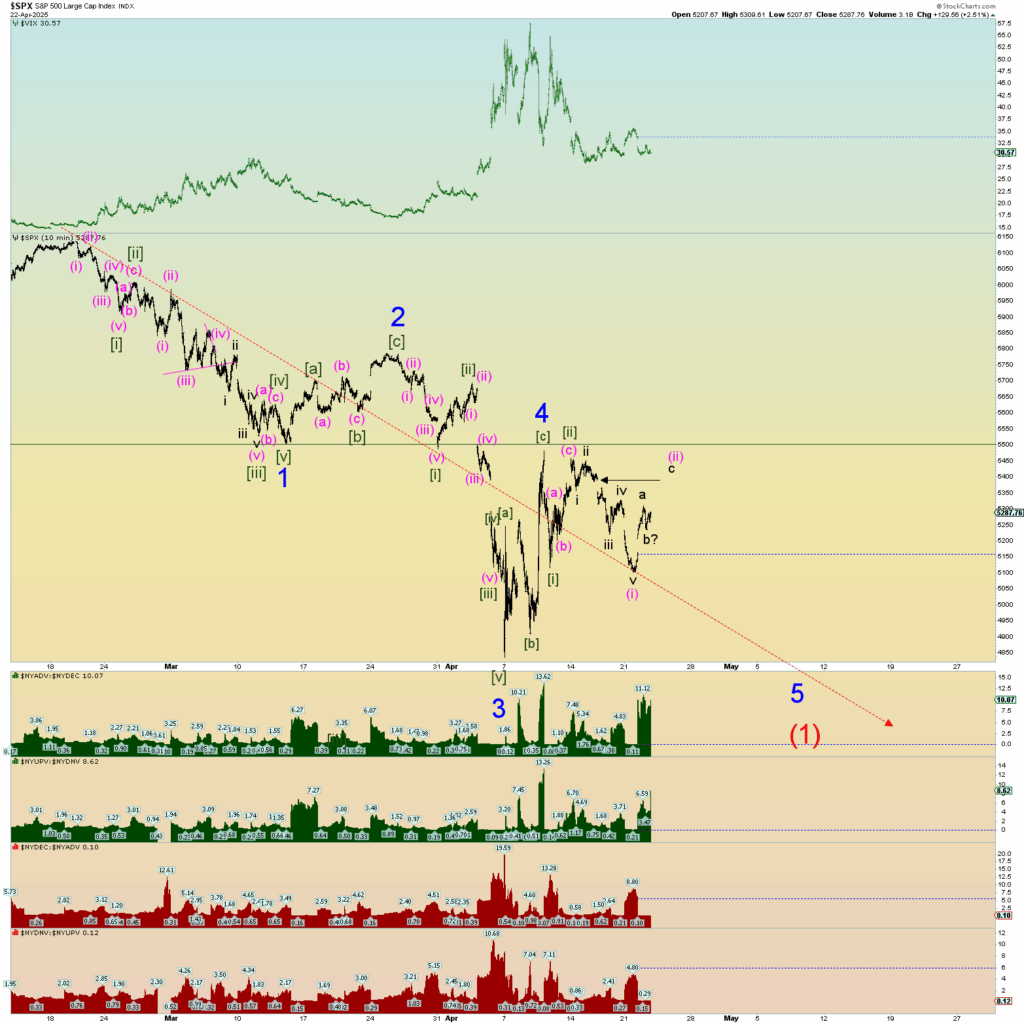

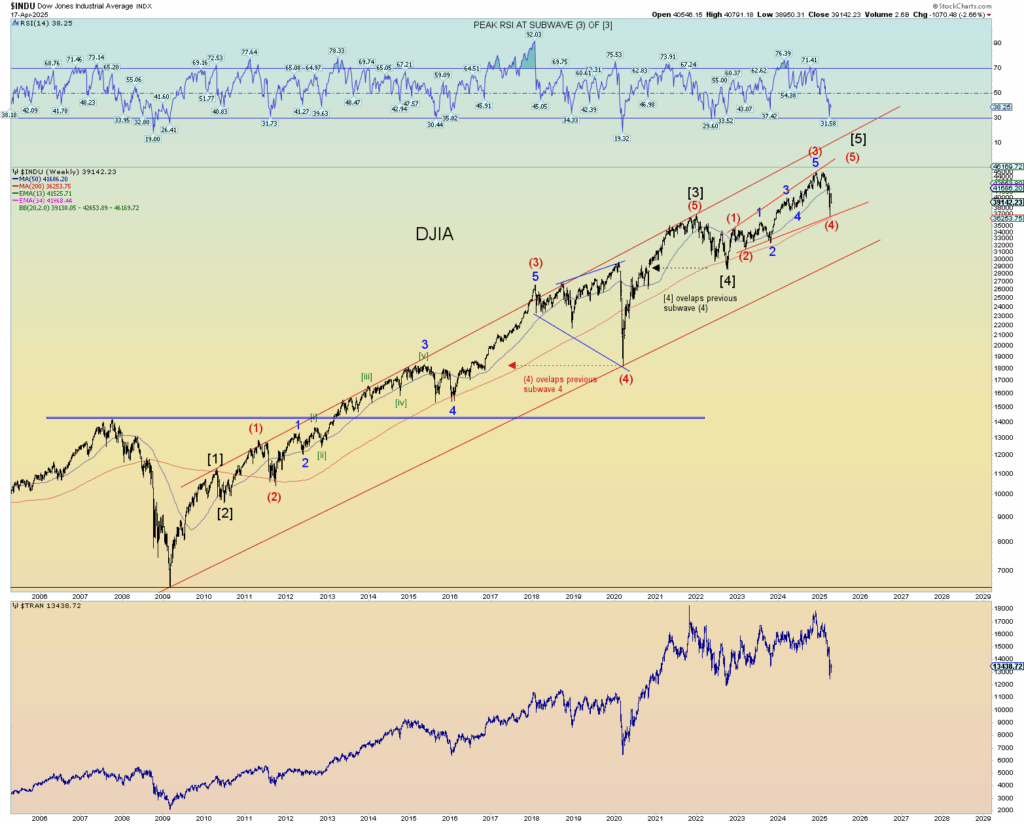

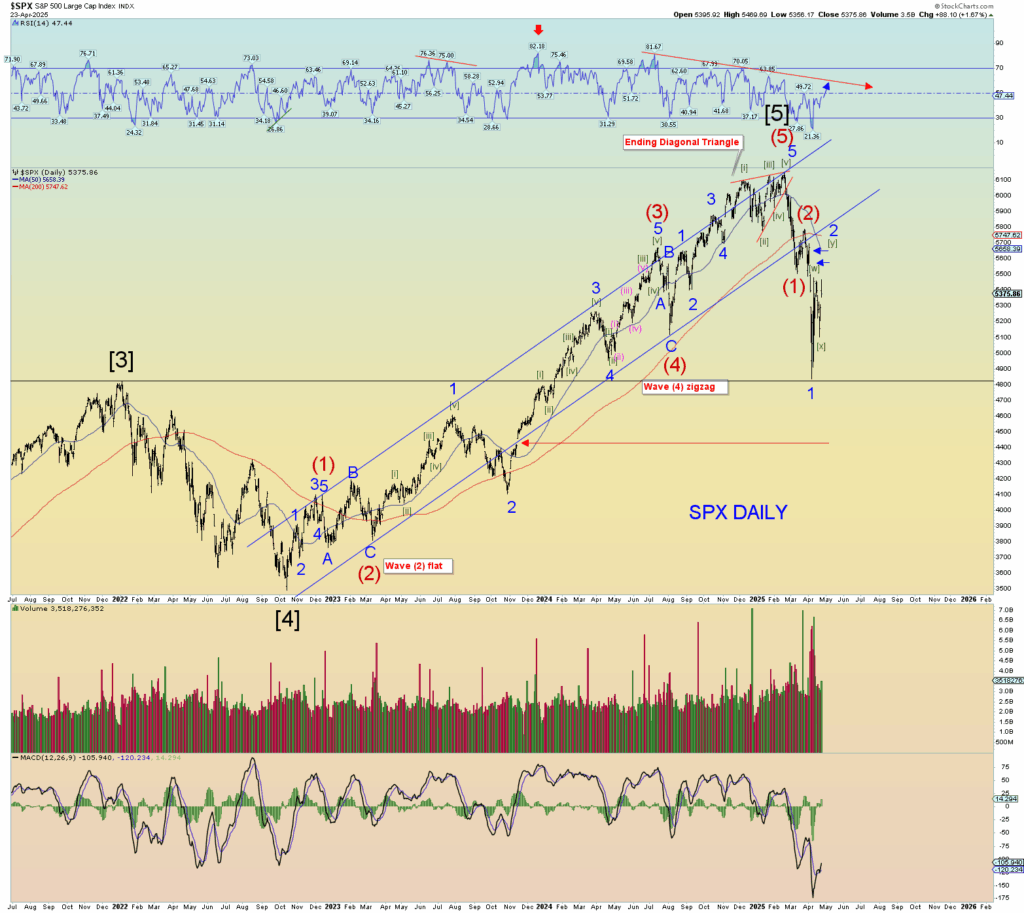

The most bullish count:

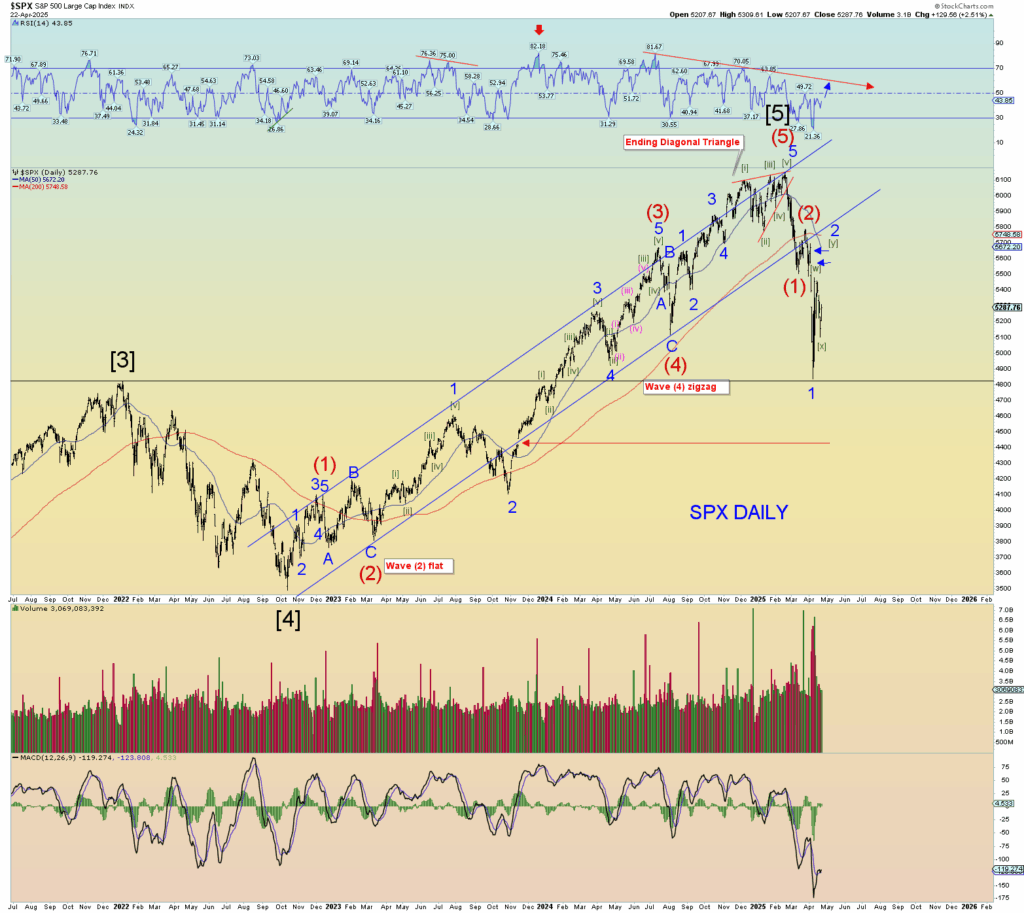

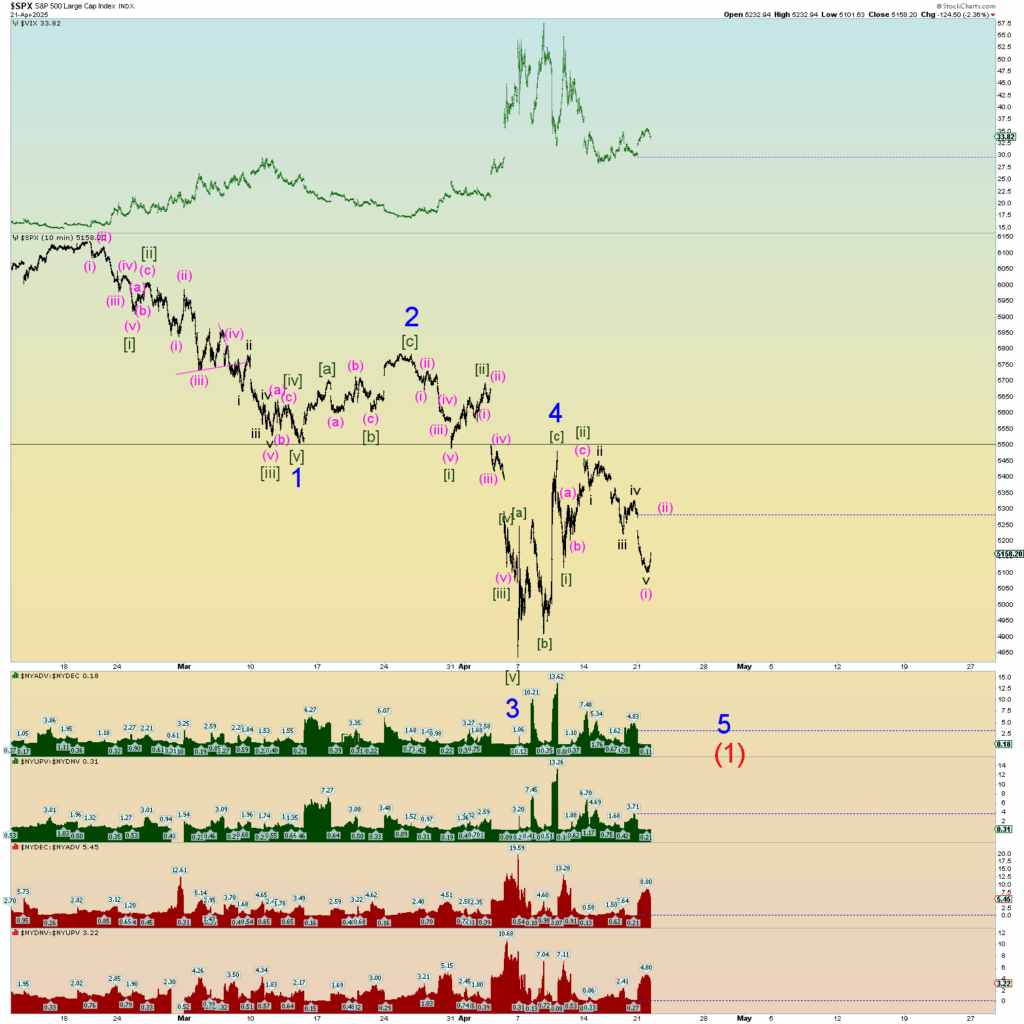

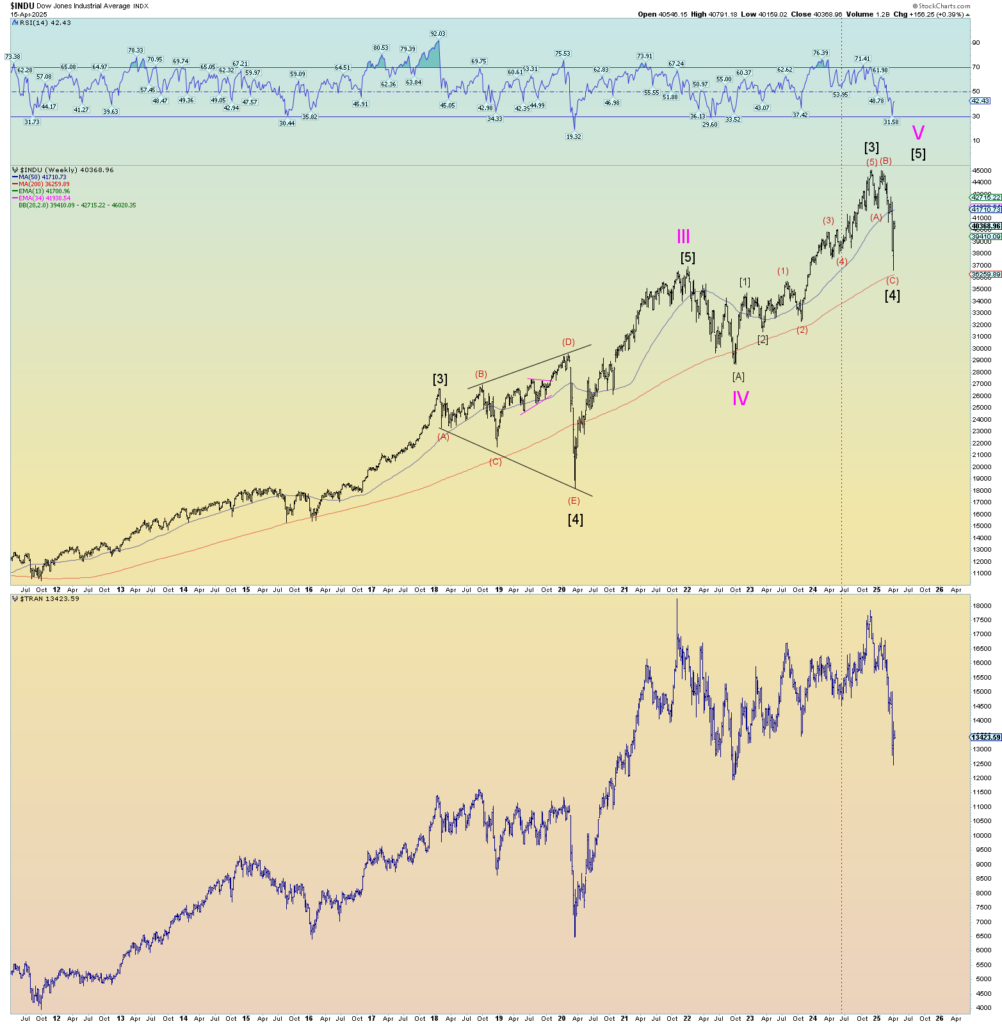

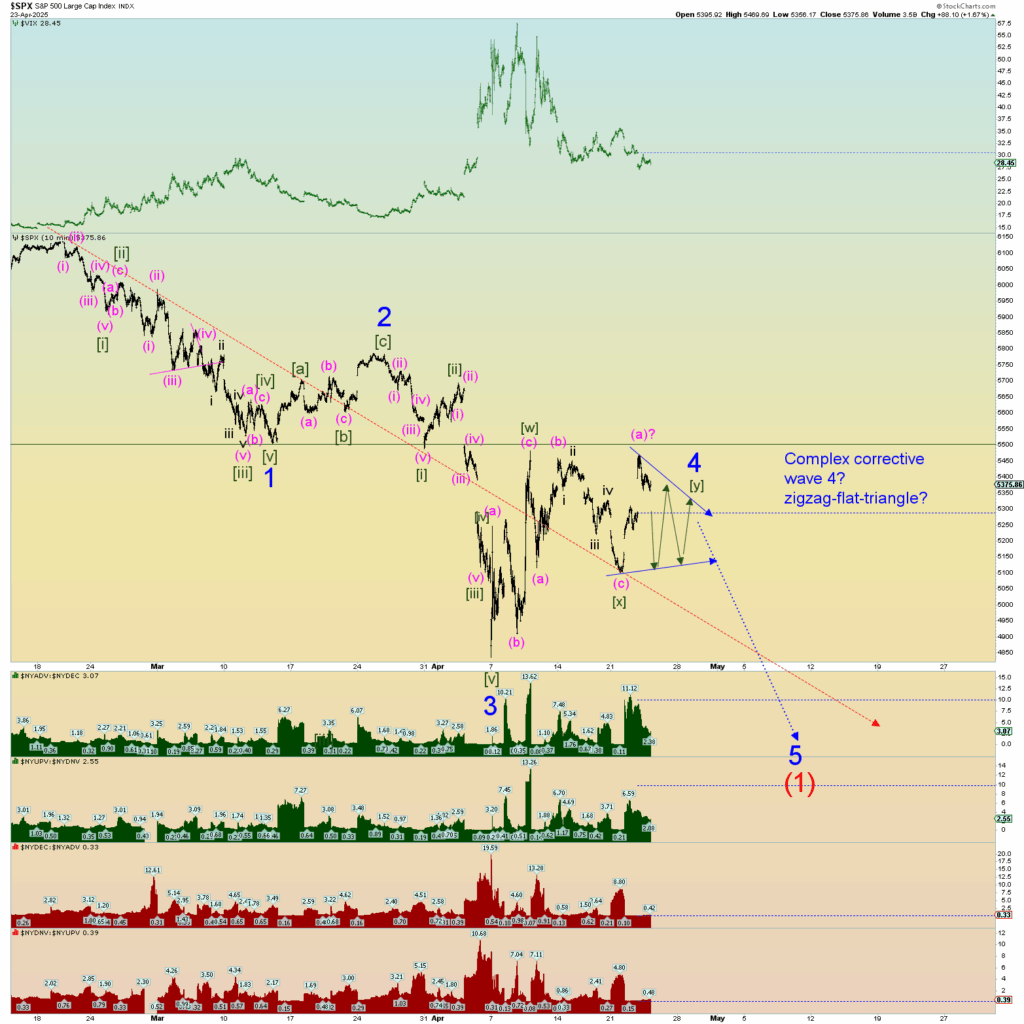

But despite last night’s rant, I haven’t given up on a possible Minor 4 count. Although it would have to be a complex corrective count and the following chart is the best I can come up with at the moment. After all, the market has ALSO left two very large gaps up opens over the last 2 days. Which side will prevail??

Even though the 5-minute charts are considered “squiggles” the size of these daily moves is actually quite massive and volatile still. Sometimes we should zoom out and imagine a count and just be patient. I can still see the above massive 167 SPX gap down being closed or nearly closed and the overall larger count being bearish.

Rulers sometimes work best in the market. It was the logical place for the algorithms to massively defend and buy.

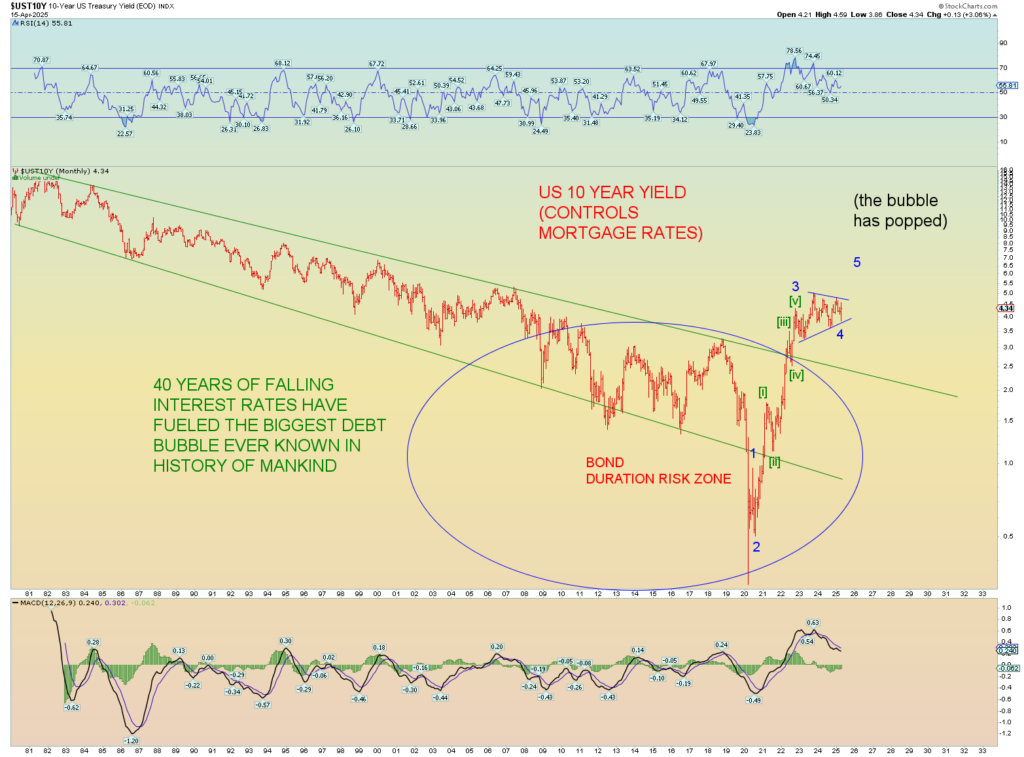

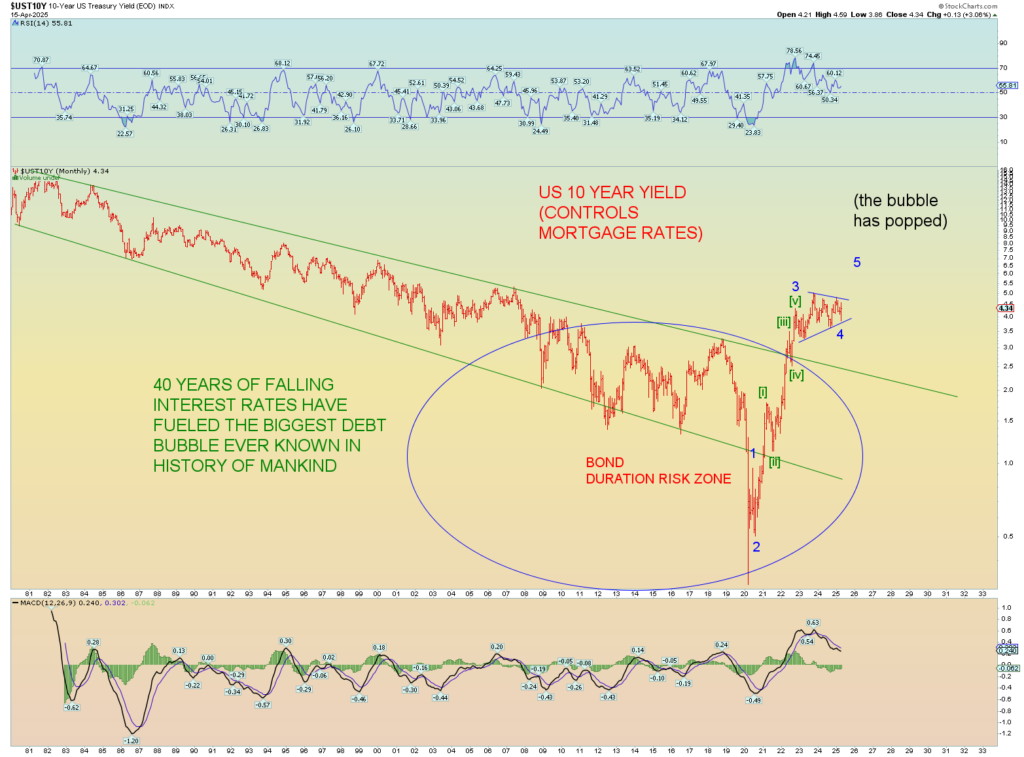

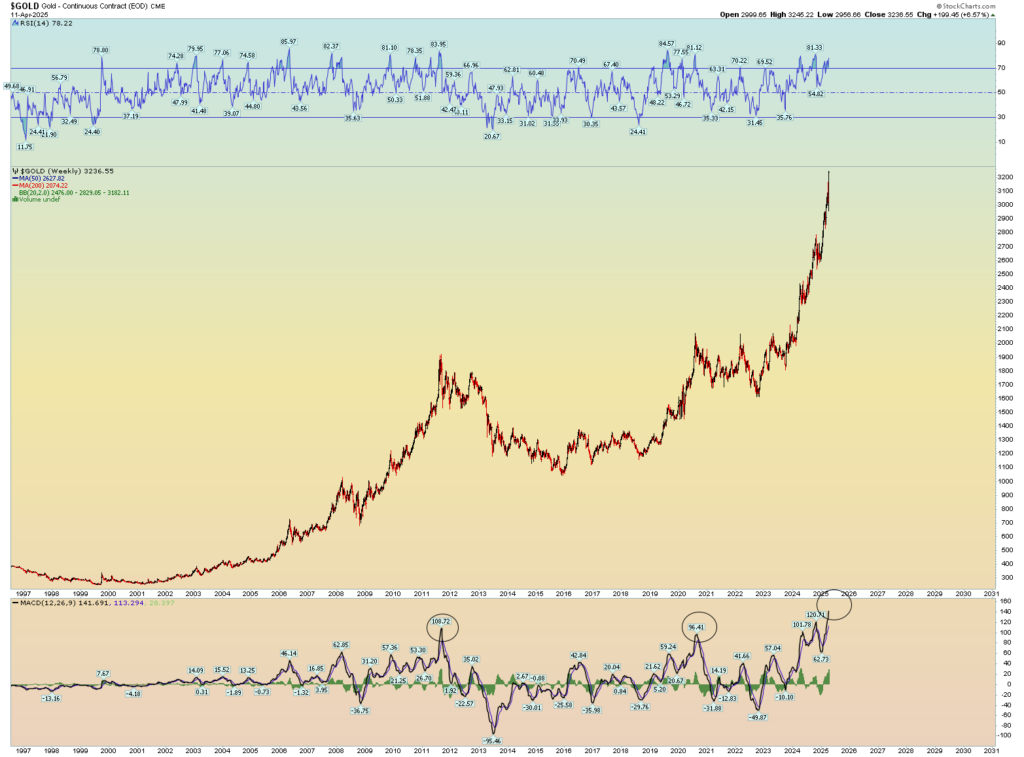

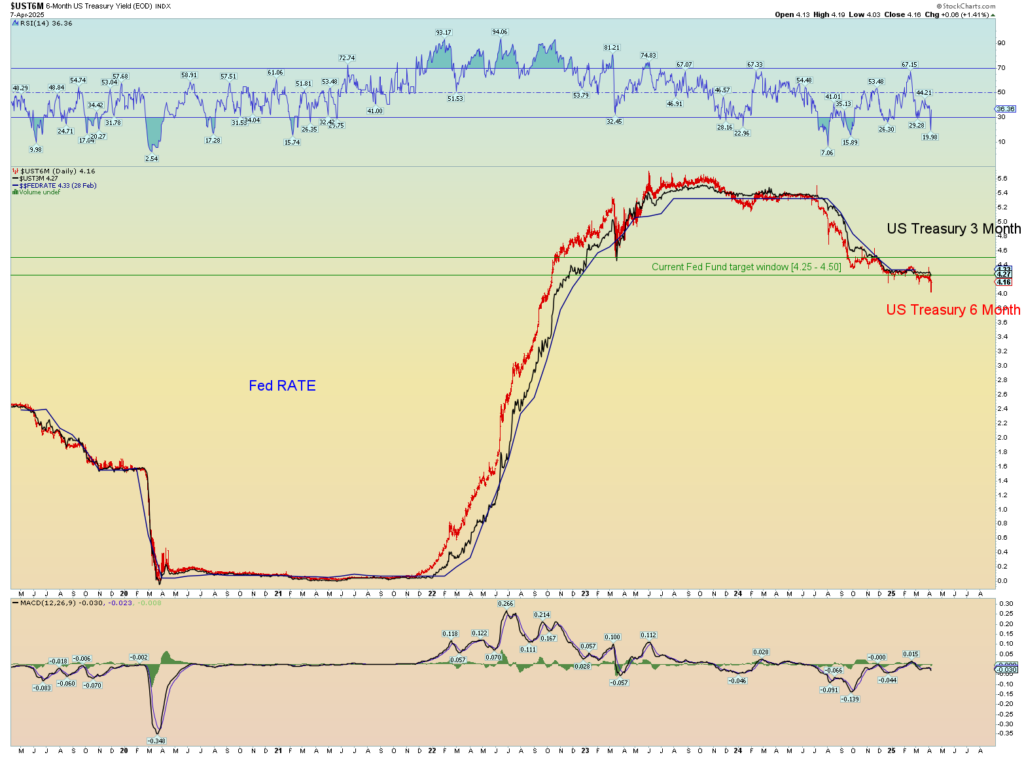

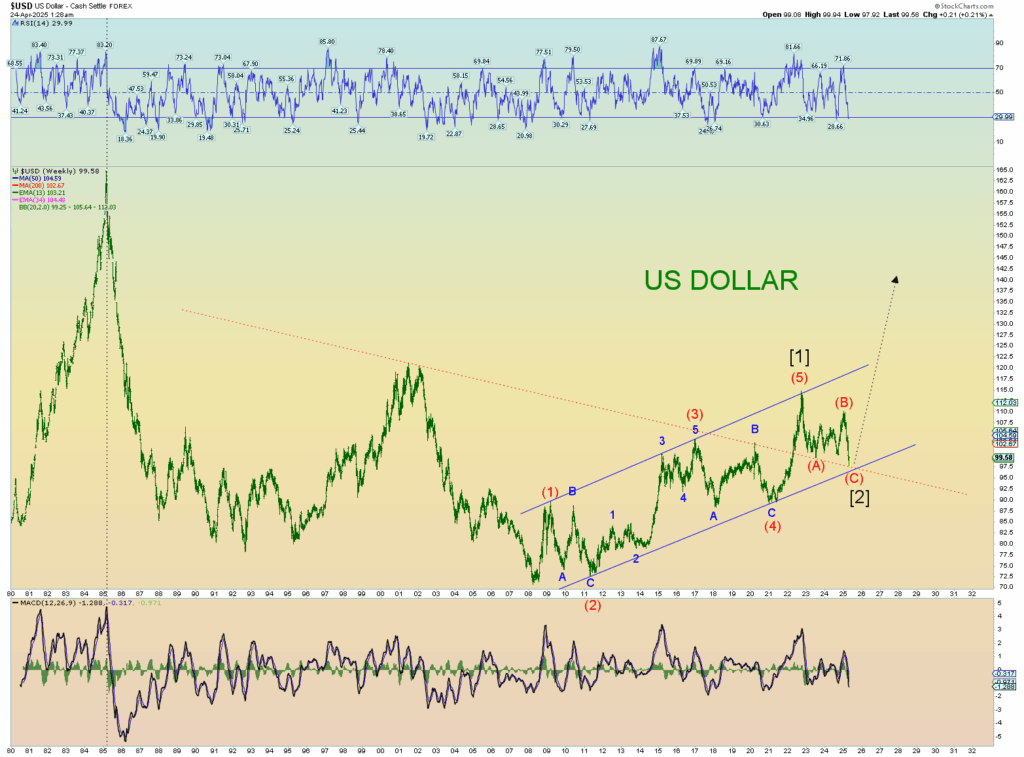

Death of the dollar talk has been rampant. Really? It still looks like an overall bullish setup.

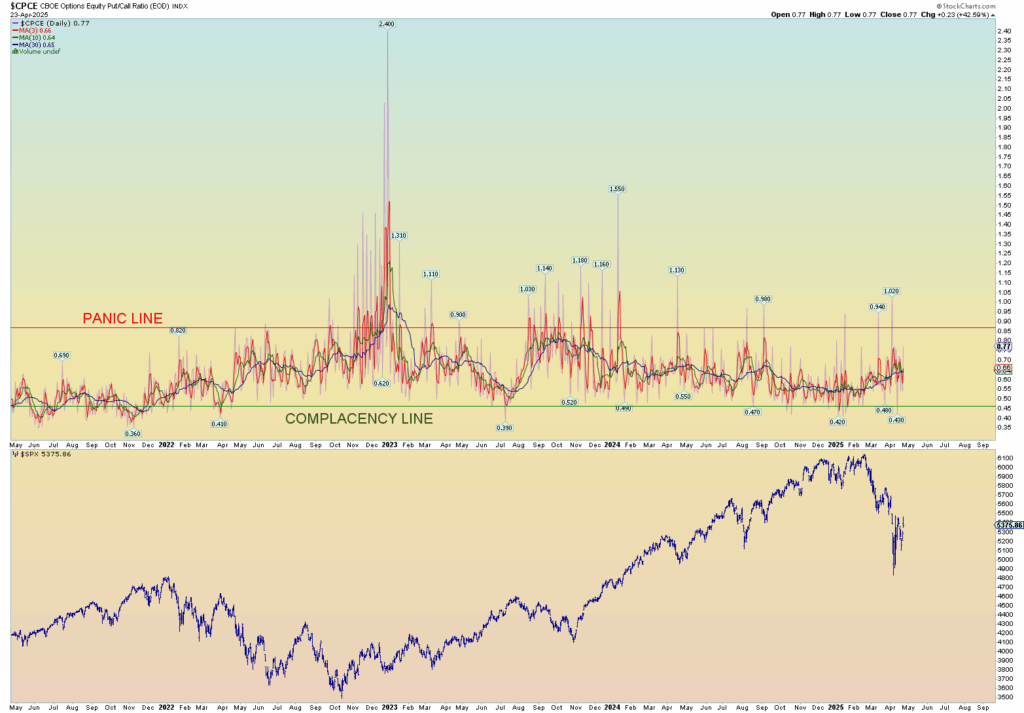

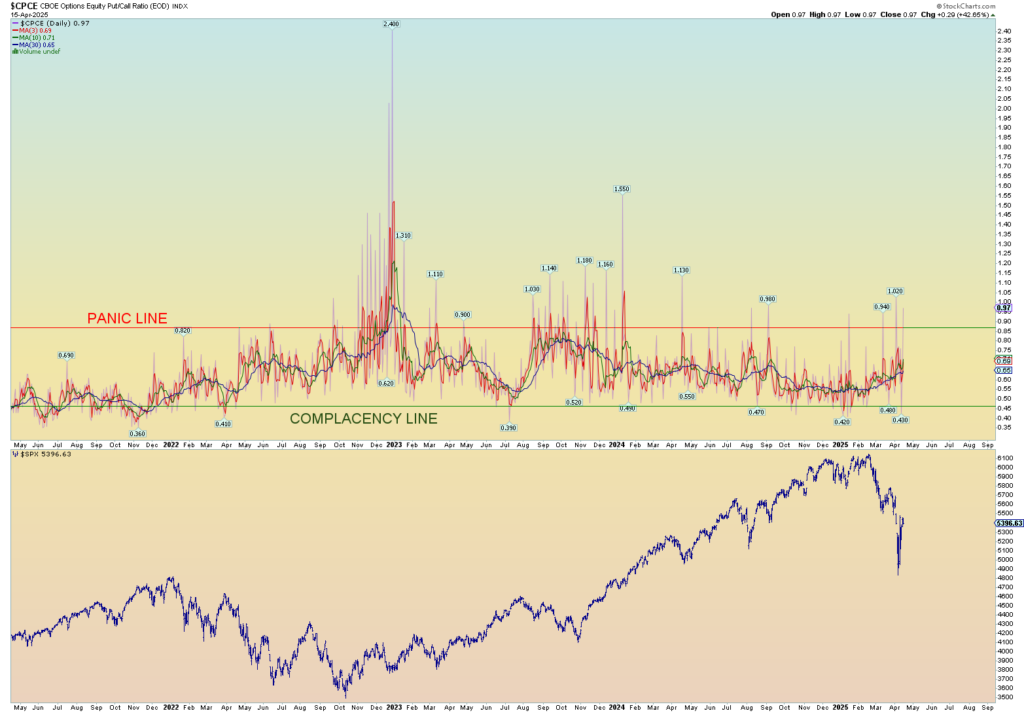

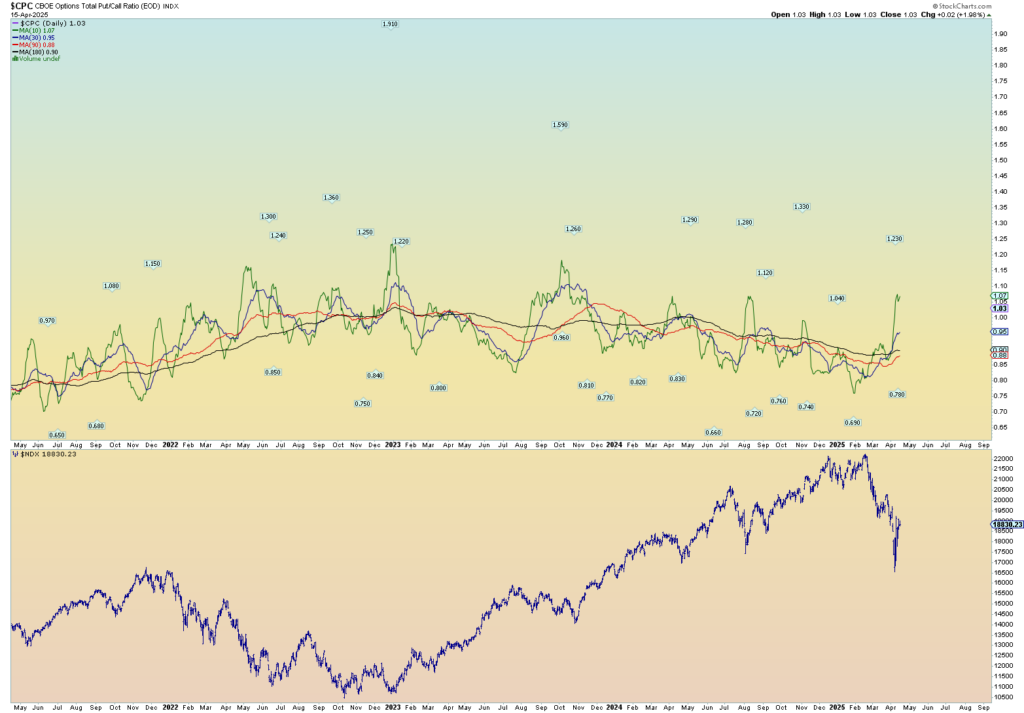

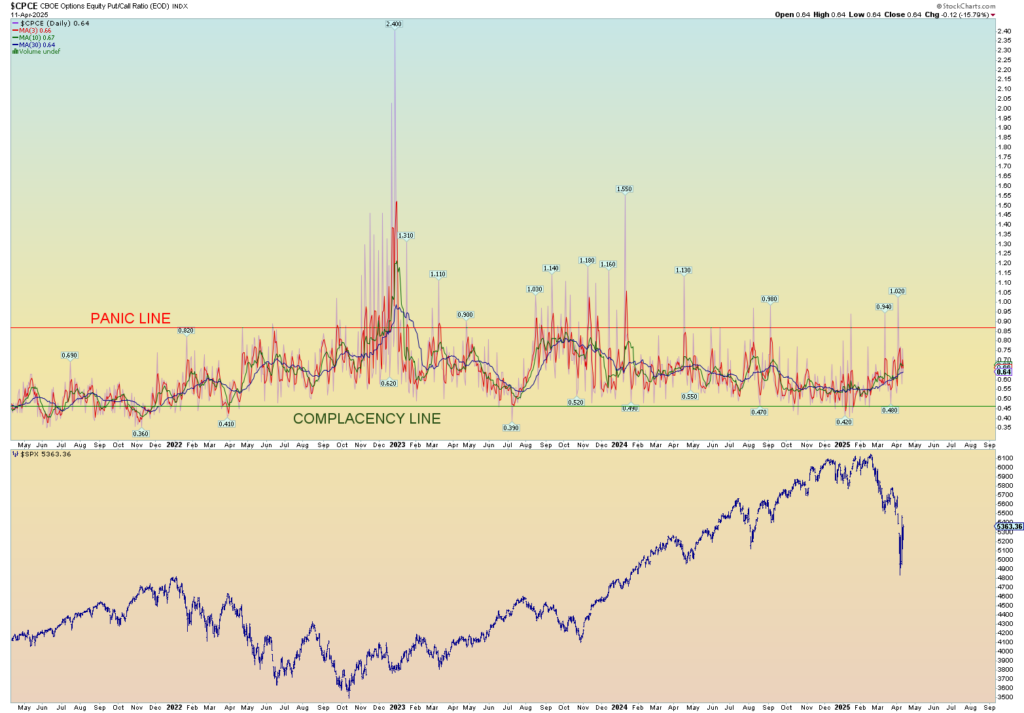

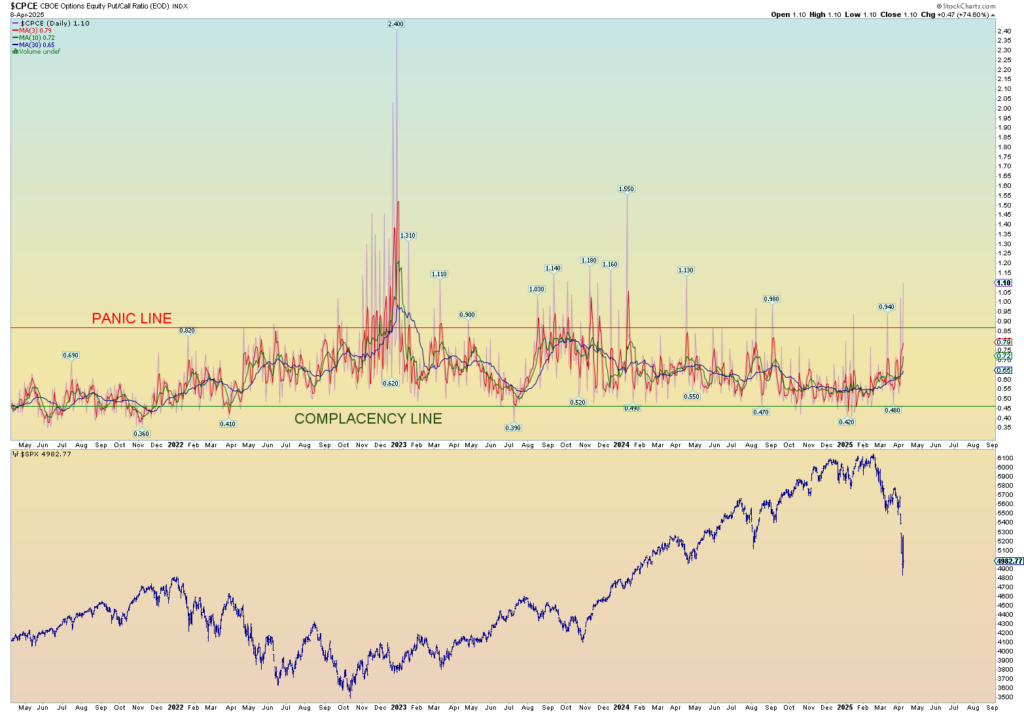

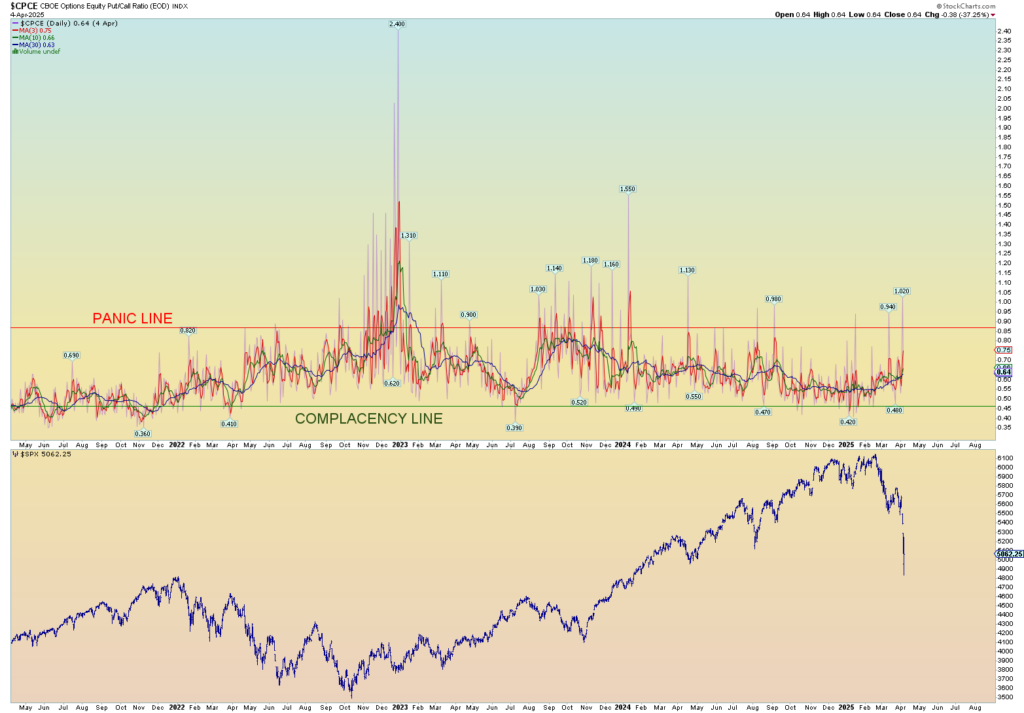

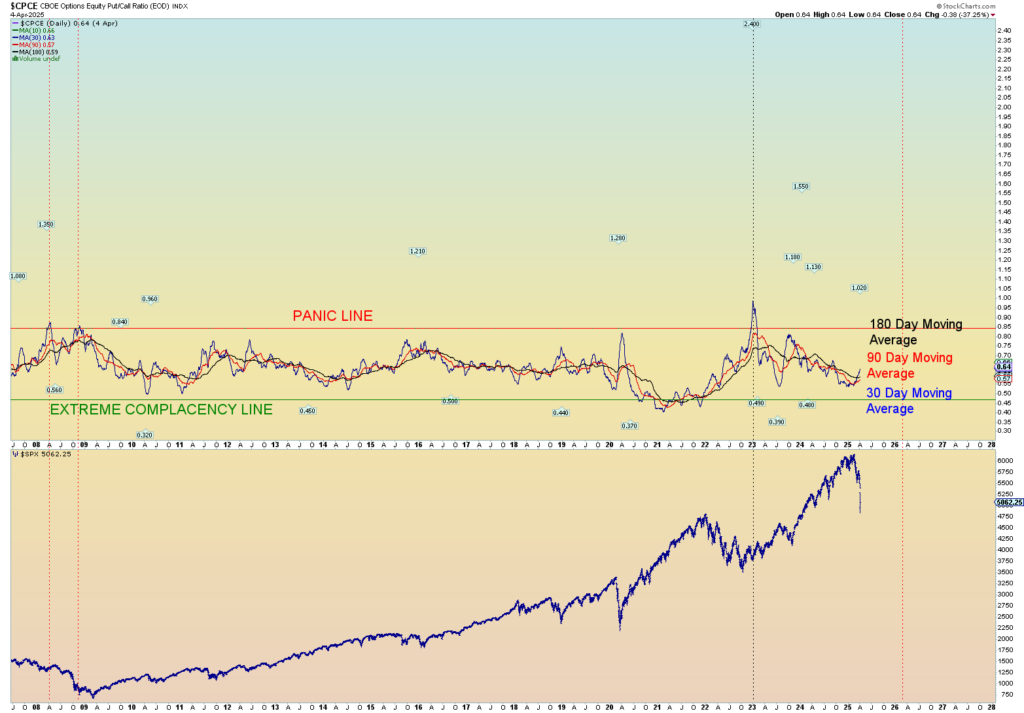

Often the markets have to experience true panic before a meaningful run toward new all-time highs. Yet, the CPCE is so still obviously NOT panicked, we can take solace that the market has not been overly “bearish”. The contrarian play is that the market is going to drop yet more first.