Very violent price action all day with a very elevated VIX. Today reminded me more of 2008 plunge and violent bounce post-Lehman more than it did 2020.

The primary count is that today’s price low was the Minor 3 low of a 5-wave structure down. This implies that a new price low MUST occur to validate this large 5 wave structure. Otherwise, so far only 3 large waves from peak have occurred. The only EW rule is that Minor 4 bounce cannot trace into Minor 2 corrective. Prices must remain below Minor 1 low and make a new low beneath Minor 3 to confirm that overall, 5 wave structure.

Here are a couple of looks:

The first supposes a major bounce to form a price hit on the proposed (1) channel line down. Prices would partially or almost wholly fill the large gap down.

The second look: Note how the bounce today hit the underside of the proposed “base” channel. This is a classic move of a wave 4 price peak in a 5-wave structure down. We are talking a multi-hundred SPX move both up and down in a matter of minutes. The violence of this market is rarely seen. Even in the midday “calm”, the 1-minute charts were moving 50-60 handles. But today seemed a short-term panic low. However again, there is a required lower low to form a proper 5 wave structure down.

So far Minor 3 has extended about 1.5 times the length of Minor 1. This is a nice ratio.

China also broke a bit. Note the overlap from the initial bounce low price peak. Which means the move up from the 321 low in early 2024 is a 3 wave move corrective.

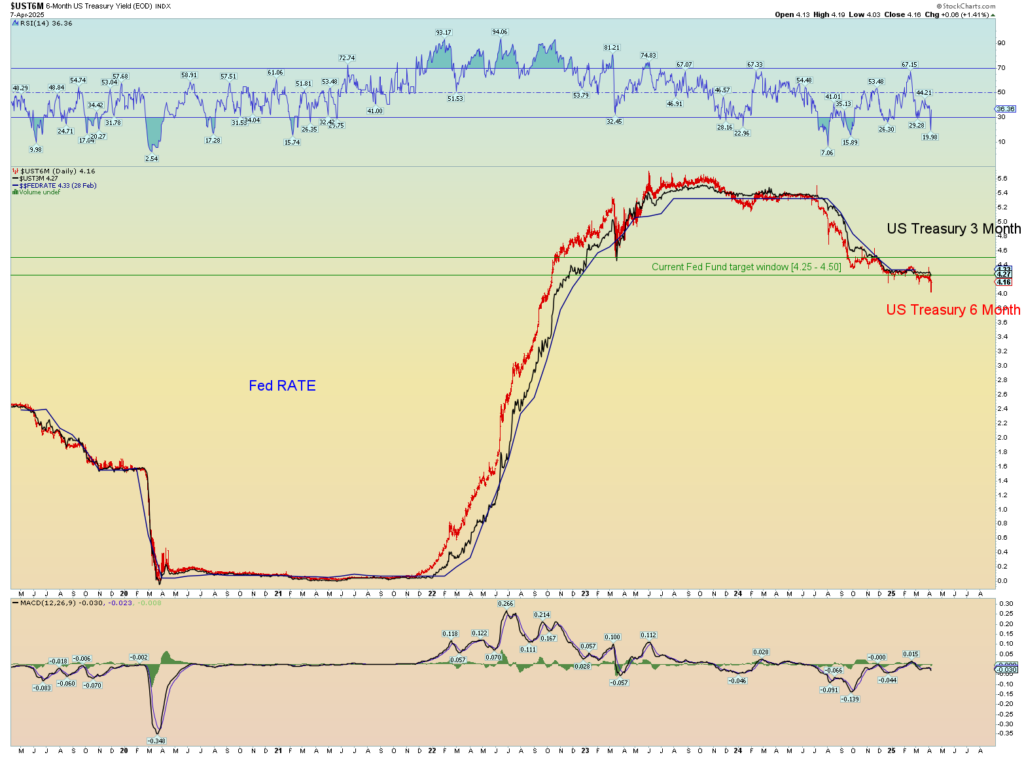

Note how in 2020 bond yields plunged in the panic. Thats not happening – yet – so far. And that is far more damaging than anything else. Sticky high interest rates are already killing the economy. The consumer is tapped out.

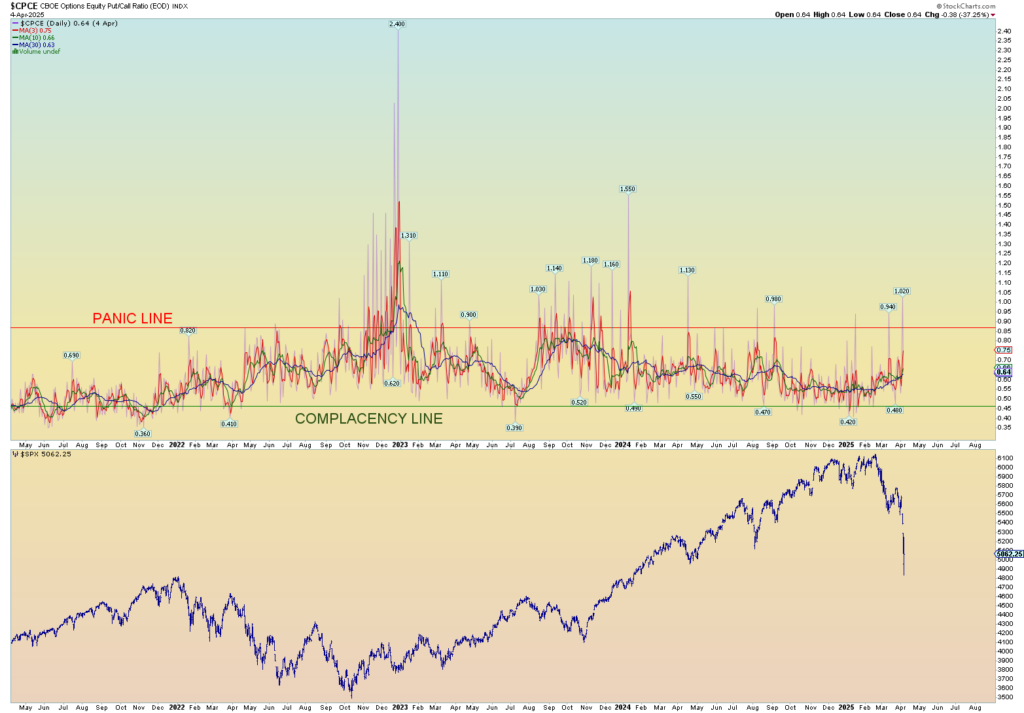

Again, I don’t have today’s CPCE data, but the moving averages are starting to budge upwards. Its going to take a lot more price plunging to get these things moving higher.

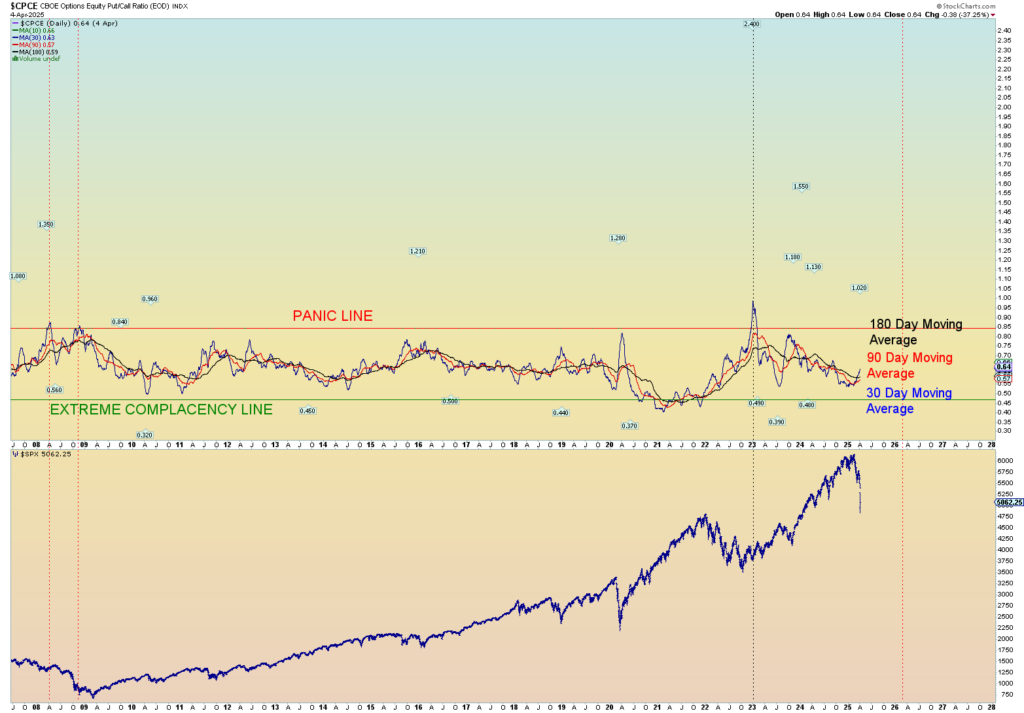

And the very long averages have barely budged.

The SPX is still a long way from even the 2020 price peak. That was only 5 short years ago. I’m confident it will work its way there eventually.

Every other panic since 2000 results in lower short-term rates. In 2020, they quickly plunged to near zero. This time seems different because it is. The 40 year down channel for yields (see the 10- and 30-year charts above) has finished its pattern and a new pattern has emerged if anyone cared to notice.