Today’s historically large intraday reversal could indicate that Minor wave 3 is actually still tracing out. Minor 3 would = 1.618 x price move of Minor 1 @ 4,746 SPX. This means that today’s peak was Minute [iv] of Minor 3 down. This actually looks good as a wave structure.

Of course there are other short term counts to consider. The market may be range bound for a while created by the violent bounce in Monday’s trading. Thus, we are in some kind of complex sideways Minor 4 corrective. The count should resolve itself. If we are still in Minor 3 down, I would expect a lower low to occur fairly quicky.

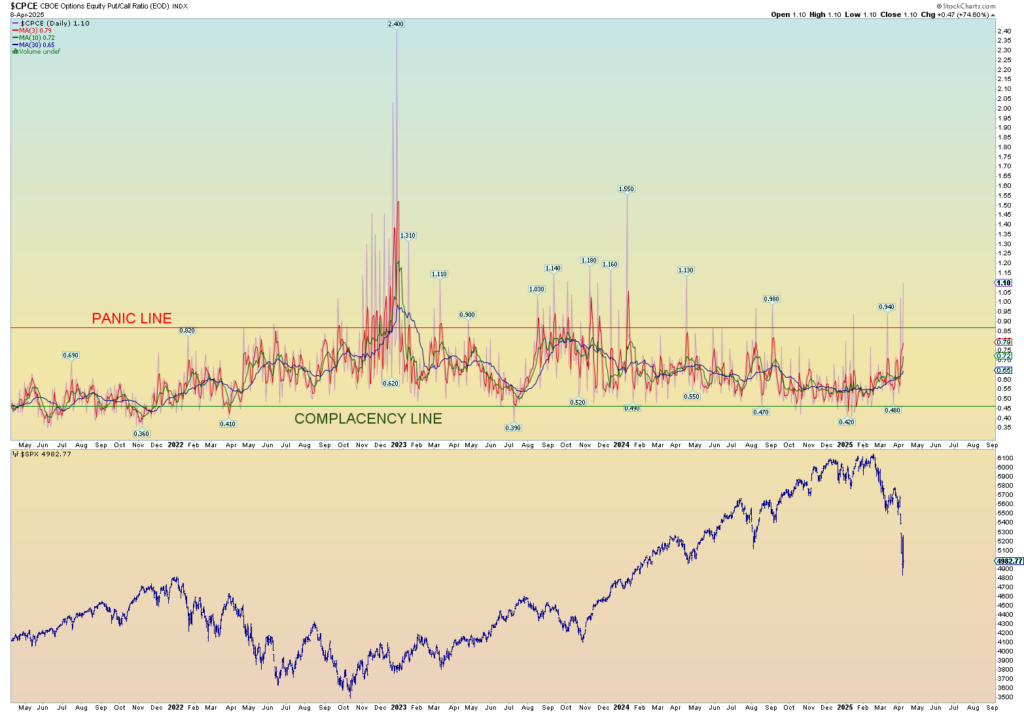

Up to date CPCE. Starting to move.

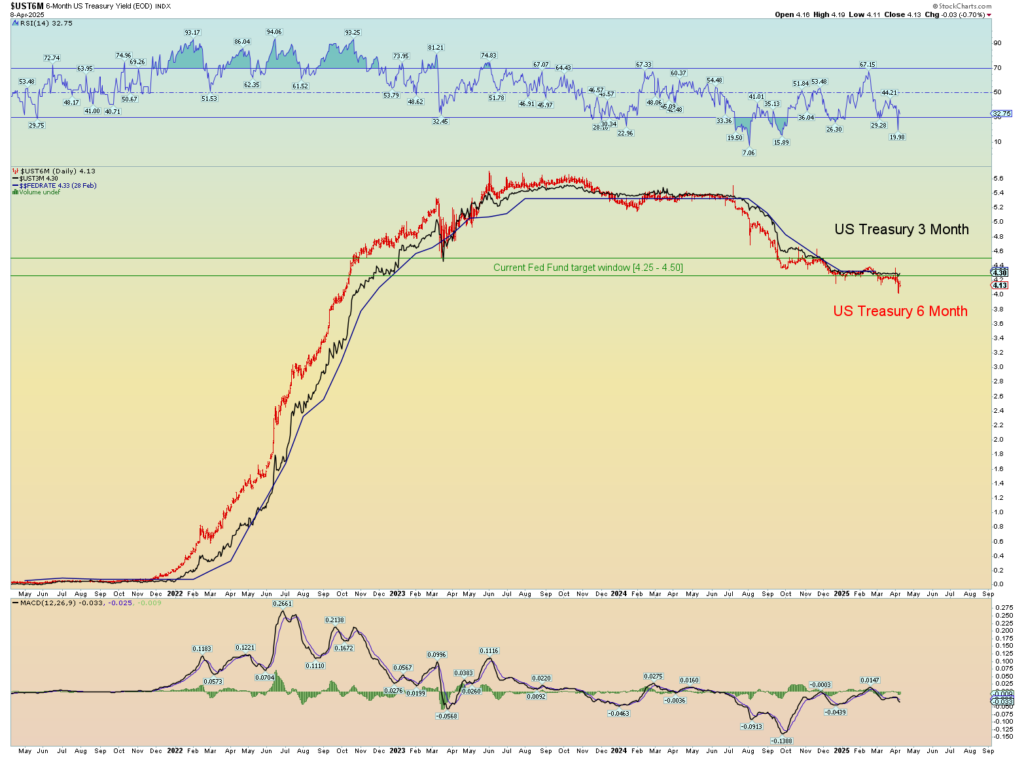

Of course, the real market killer corporate killer is the short-term 3- and 6-month T bill which determines where the Fed places the short-term rates. Barely budging despite the +50 VIX.