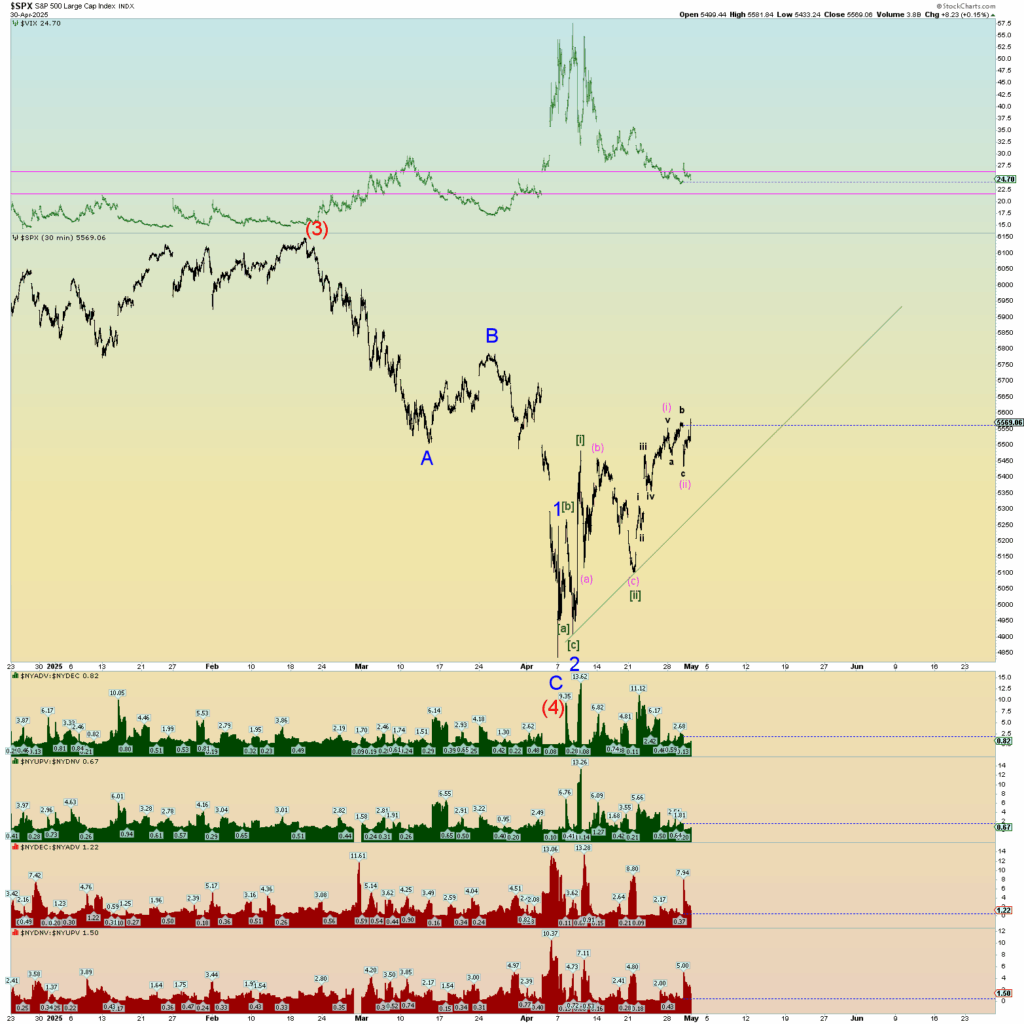

The bullish count which seems to be winning out, has the market about to experience “upside surprise” or the middle of a wave (iii) of [iii] of 3 of (5) up. “Thrid of a third” up.

Like I said in yesterday’s post, for the bears to regain control, they need to induce a very sharp selloff that gains downward momentum and breaks things again. They gave it their best shot today and as soon as I seen today’s gap down early low and the price action for the next 20 minutes or so, I labeled this chart as such, and it held up all day.

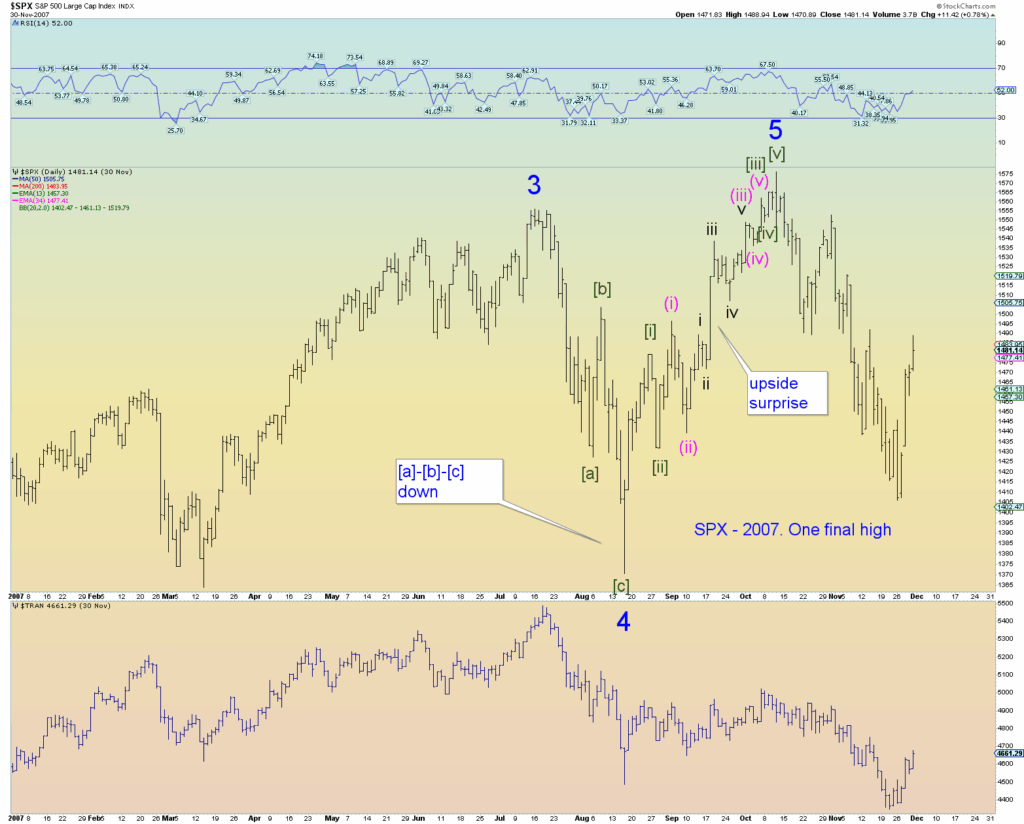

The setup today reminds me perhaps of what happened in 2007’s major market October peak. We had a sharp [a]-[b]-[c] down – a 12% drop, spike bottom – and then a series of very large [i]-[ii], (i)-(ii) and i -ii up. (Obviously 2007’s waves are labeled one degree lower). Then came upside surprise and then a quick series of wave “fours” which finished the pattern.

The path back to the top, despite being 1 wave degree lower was fairly quickly. About exactly 2 months. If we extrapolate that the same thing is happening today, by about July 4th we should be close or have already topped. Again, this is just a quick wag based on comparing 2007 to today at 1 degree wave higher.