COMMENTARY

Since I am playing catch up with the scriptures one of the things I am learning about is what is to happen at the end of times. I found Greg Laurie on the You Tube and his website has an entire sermon series about the Book of Revelation. He is pretty funny too at times. I like his preaching he doesn’t sugarcoat anything and he isn’t trying to sell me anything. I watched a handful of his You Tube videos and will watch many more (and not just about Revelation). Since I don’t go to any organized church, this is something I realize I need is to have someone teach. Again, I think God led me to choosing his sermons for whatever reason and watch a few every night before bed. So I thought I’d pass that on.

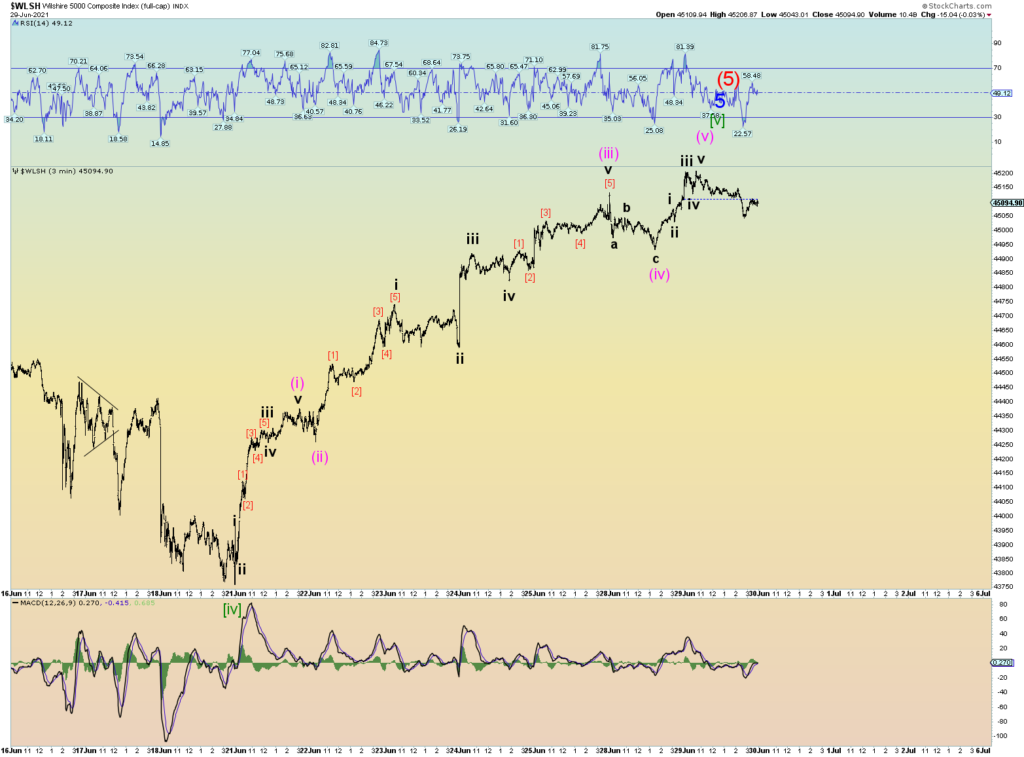

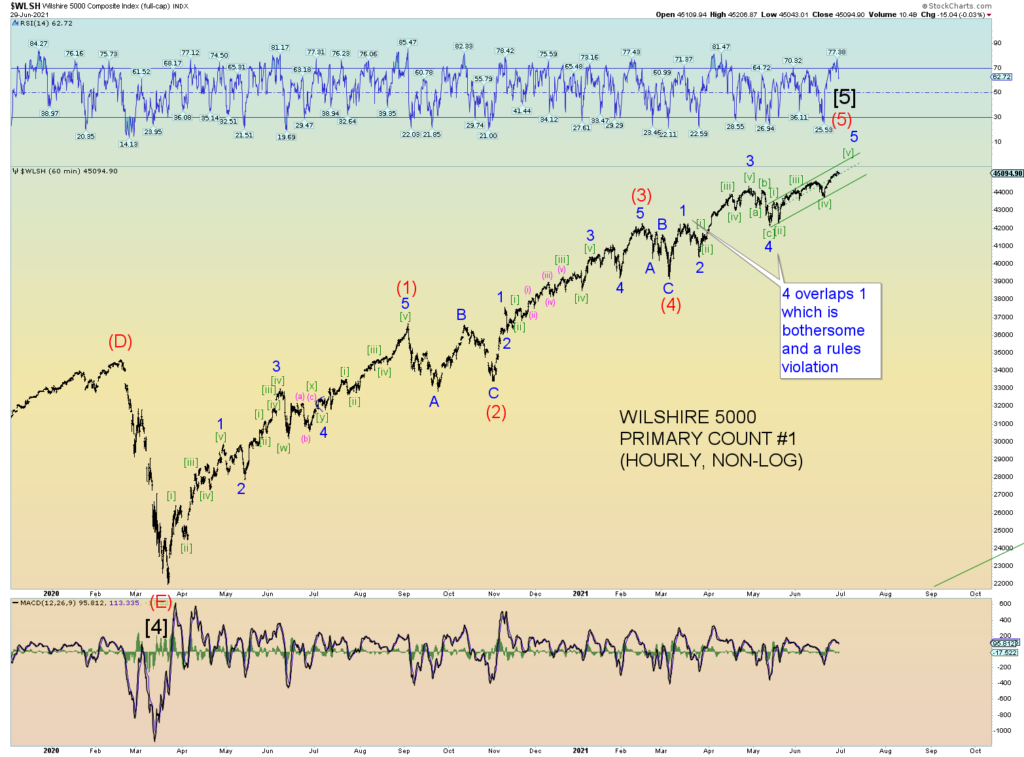

THE COUNTS

Well, there are enough waves in place to consider the count complete, however we’ll give the count the benefit for end of quarter window dressing as per the second squiggle chart.

The next Fibonacci number is 46,368. If that is the true target, we have some more work cut out for the market. Yet when viewed from this angle, it almost seems likely to happen.

There is still a bothersome thing about the count as shown above is that wave 4 low in late April 2021, overlaps with 1. The “extended fifth wave” count is still a very attractive count and if one were to strictly follow rules, it should be labeled as below which implies there is work to be done. Again the next Fibonacci number is actually within sight at 46,368. Today closed 45,094.

The count is called the “Tower of Babel” whereas it literally keeps running up in price and time to the point of the “Rapture” which could be occurring anywhere from sometime in August or maybe the latest, mid September. I would imagine that event would spark a crash. And then the beginning of the 7 year Tribulation which should come in with a bang of some sort.

What’s interesting about the count below is that every correction since red Intermediate (4) is a simple zigzag which would be expected in an extended wave (5). The dynamics of an extended wave (5) on such a scale means there is only time for a simple price dip in the form of a zigzag and then immediate bounce and move onward. That is just the nature continuous clawing upwards in a final spurt of energy at an enormous Grand Supercycle Scale. Indeed a double Millennial scale!

Again, this is the count if the market keeps humming upwards for another month or more and volatility keeps dropping lower and lower. Recall that is what occurred in 2019 to the February high. And also it would happen to workout that Minor wave 5 itself within extended Intermediate wave (5) would also be extended. And that is a supposed to occur also.

Remember what happened in the real Tower of Babel event, the people were scattered, and thus the tower abandoned. Basically, the entire investment was a bust and then some.