My prediction is this will happen again on the field in the NFL or another “big 4” major sports because of the “vaccine”. I surmise that most high-paying NFL/NBA/MLB/NHL players have faked their “vaccinations” via fake cards or fake shots. There are too many billions of dollars at stake and the billionaires who own these clubs of modern-day, well-paid slaves don’t want to mar their “investments” so no doubt much fraud is/was involved with the “mandates” put in place by sports.

But the unfortunate or the stupid did not escape the nightmare of the clot shots. Or the people who actually “believed” in the “vaccine” or the people who simply didn’t make enough money to warrant a fakery.

The Great Reset continues apace.

The Satanists who have a true say in how this world is run, the Davos World Economic Forum crowd, want most of us dead and the rest enslaved. This is not even a dispute anymore. We are useless easters in their eyes and they have flatly told us so. All we can do to protect ourselves is to get saved to the Lord Jesus Christ by believing that he died for our sins for us. It’s that simple to be saved.

The bible says the 7th Babylon world empire will form, there will be a great tribulation of Christians and they will be overcome by the ruling Antichrist and his minions. A one-world currency known as the mark of the beast will go into effect. Satan will overcome and defeat Christians in the flesh. But spiritually, we overcome the world.

THE BIBLE WAY TO HEAVEN – Pastor Steven Anderson – YouTube

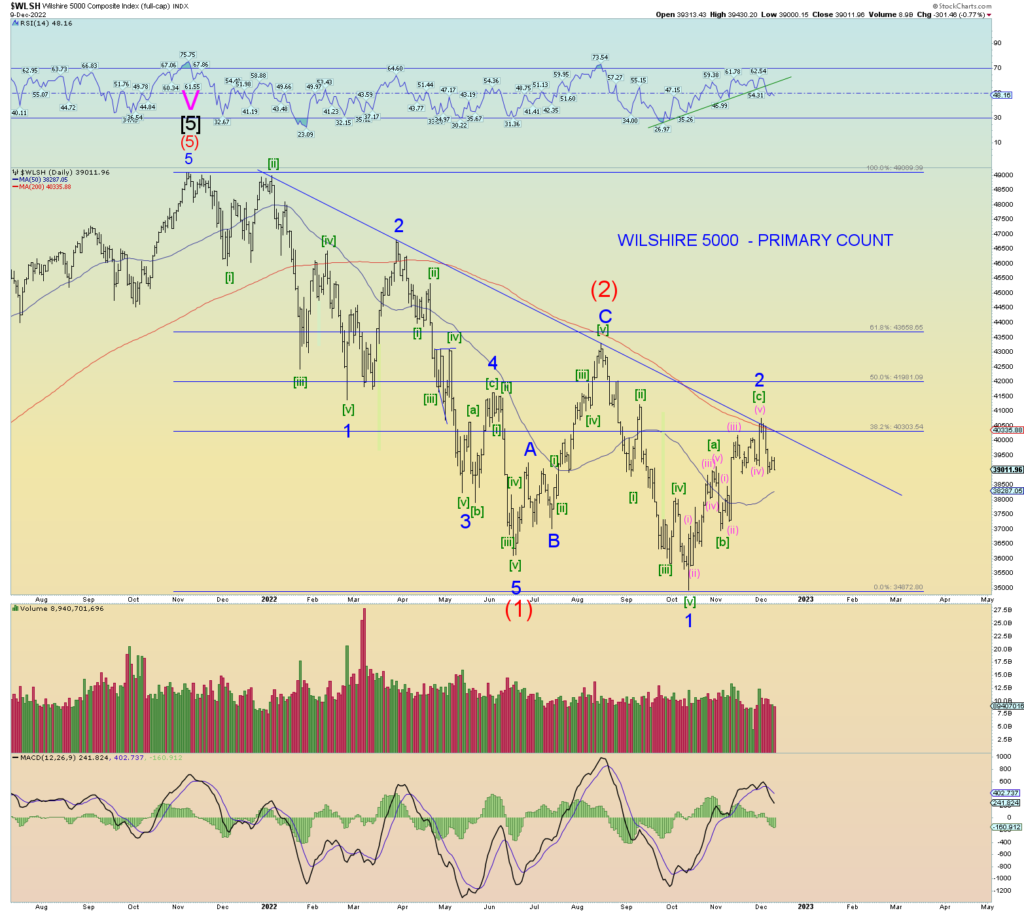

THE COUNT