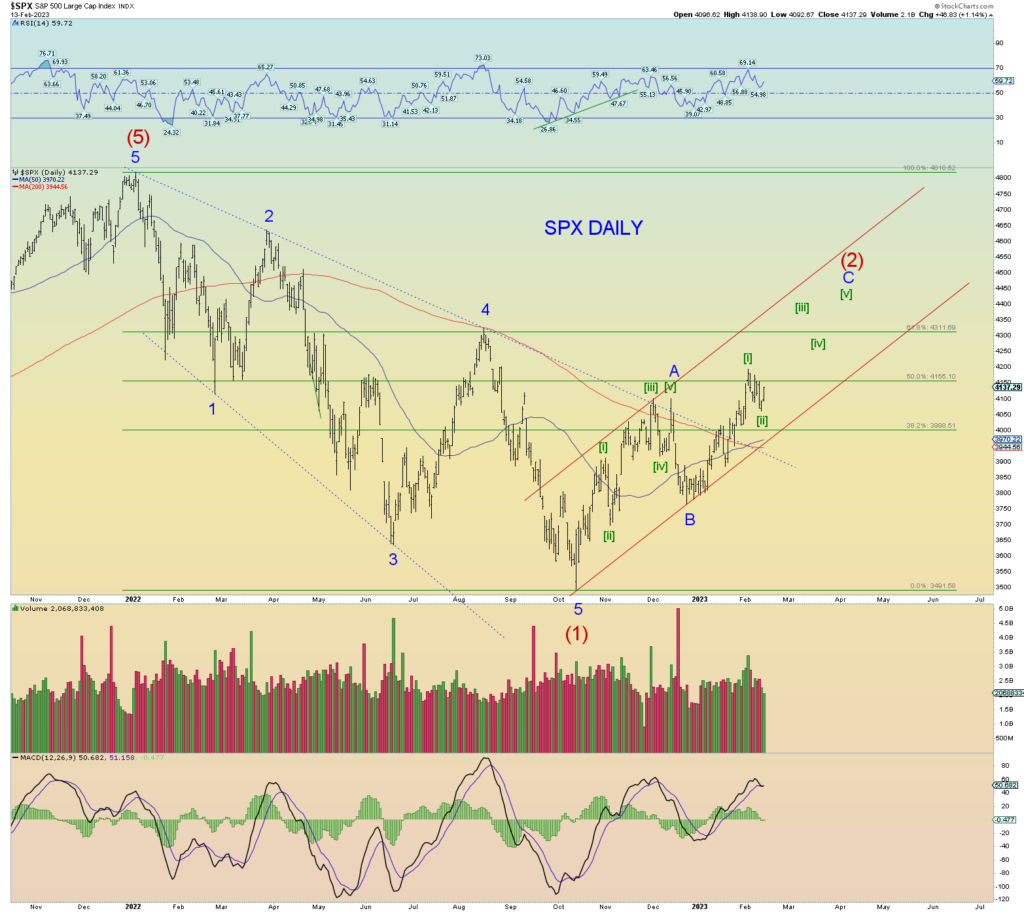

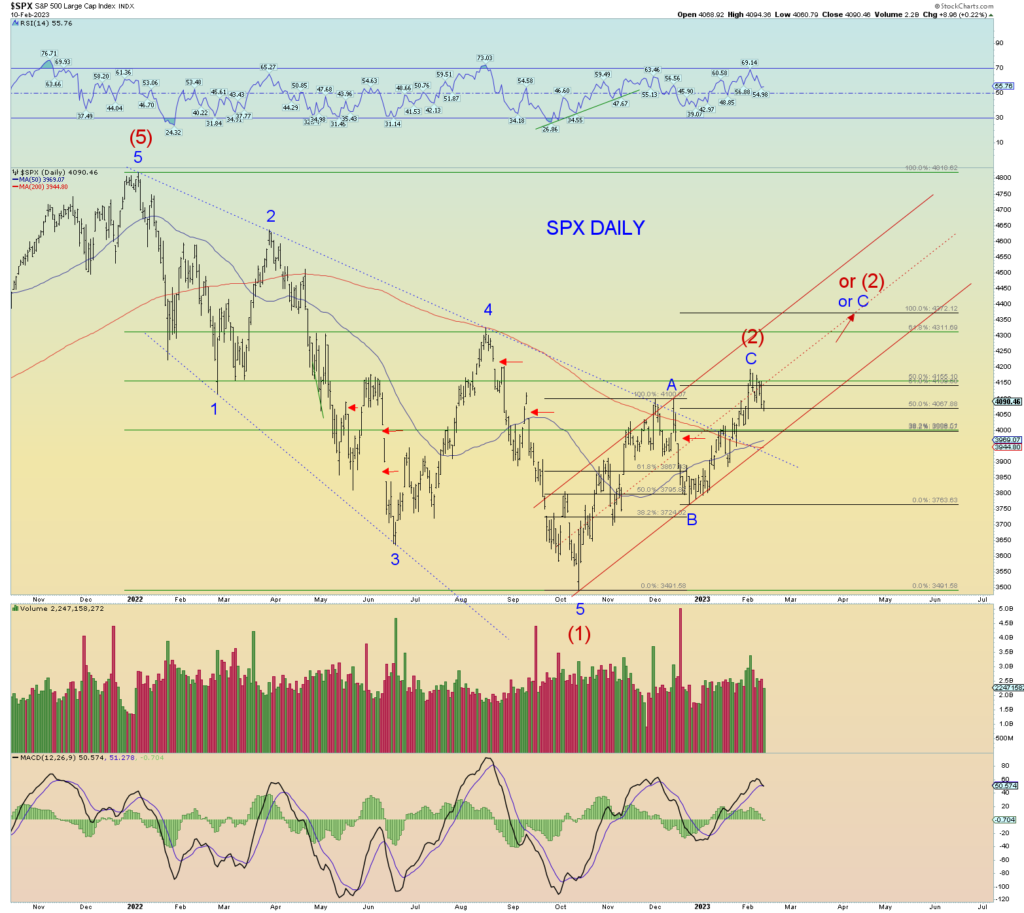

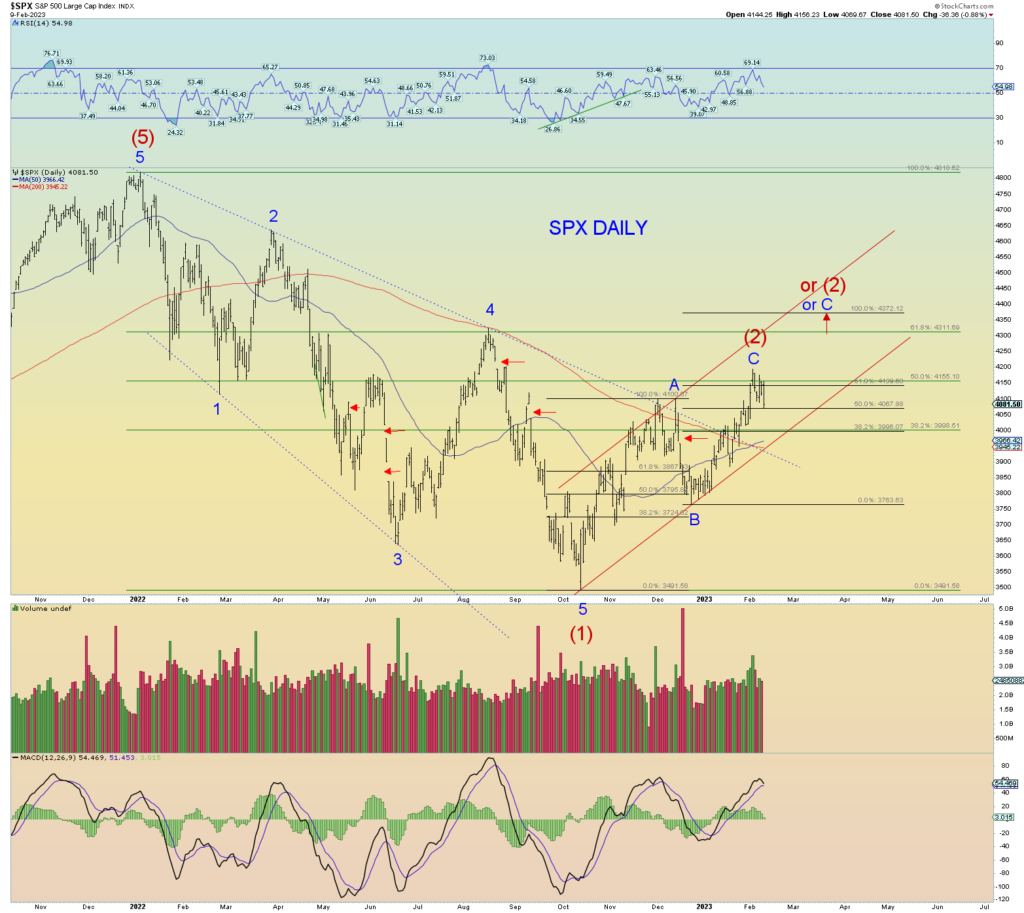

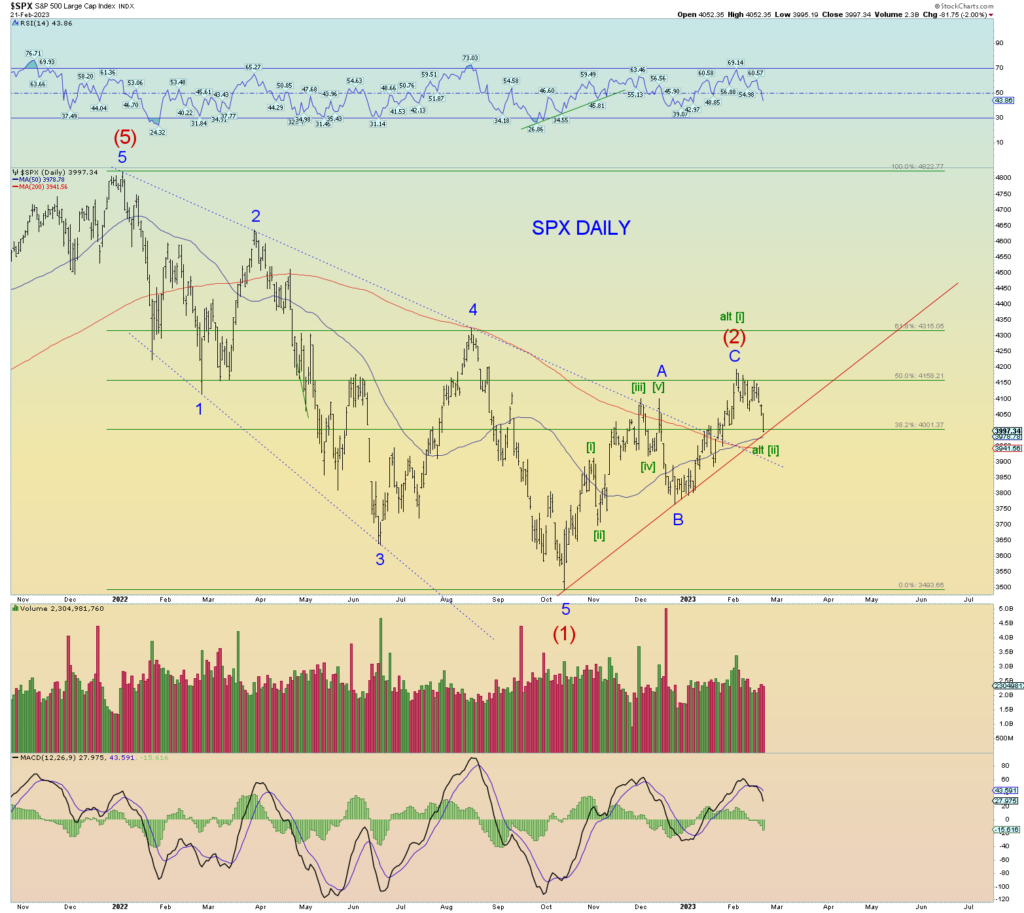

The recent report that “retail” has gotten back into the market in a record setting pace one can surmise that Intermediate wave (2) is probably over. And they will probably be “holding the bag” yet again.

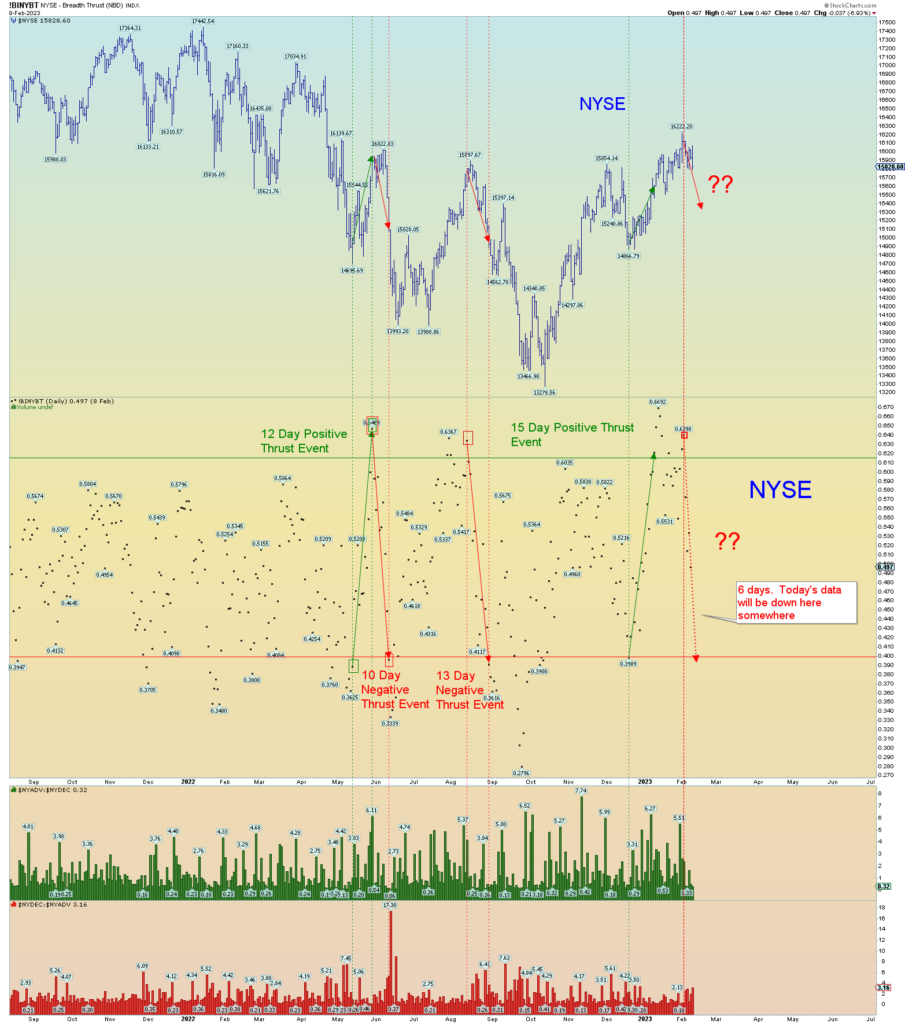

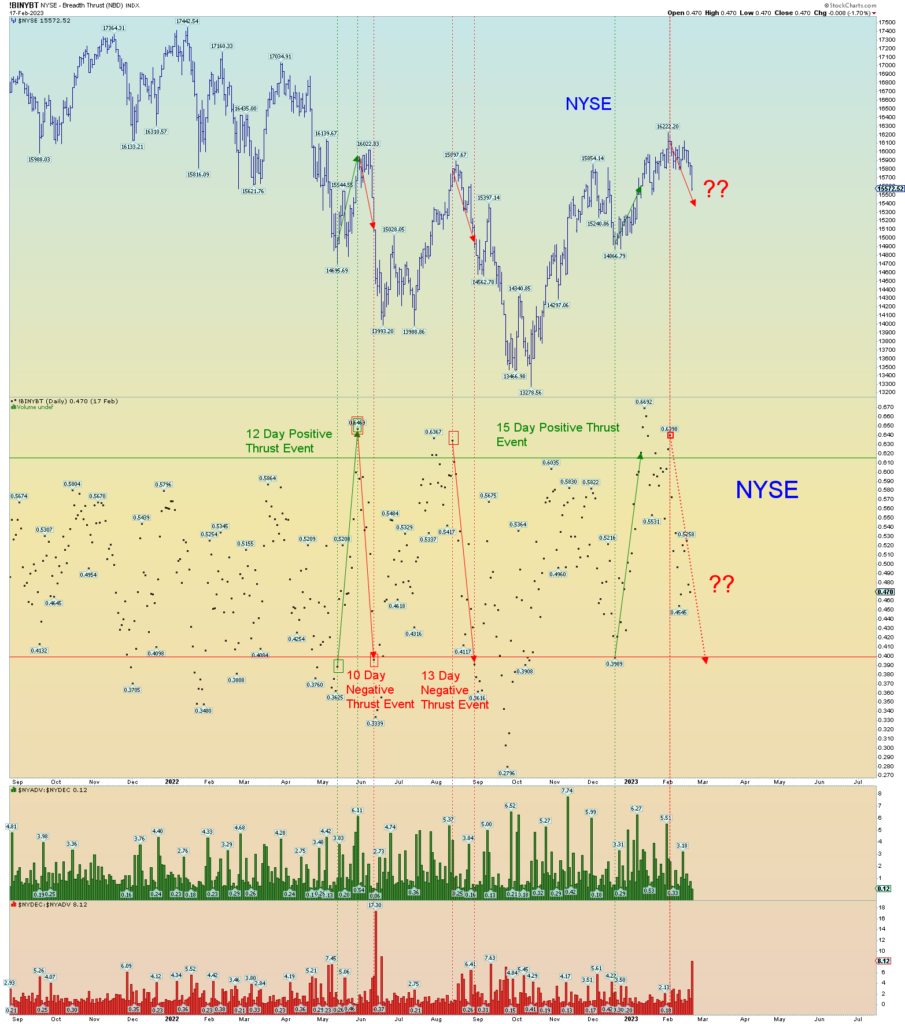

Coupled today with extremely negative downside internals on the NYSE – the worst day since the panic days of June 2022, also gives strong evidence that the trend may just have shifted back to down again. Thus, today could be called the “kickoff” in earnest of wave (3) down.

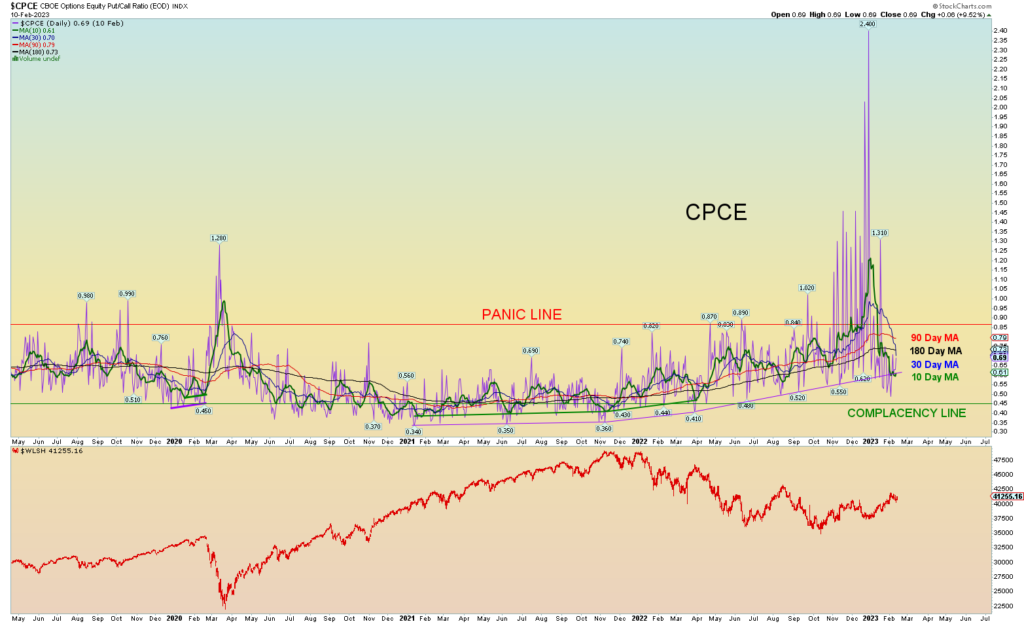

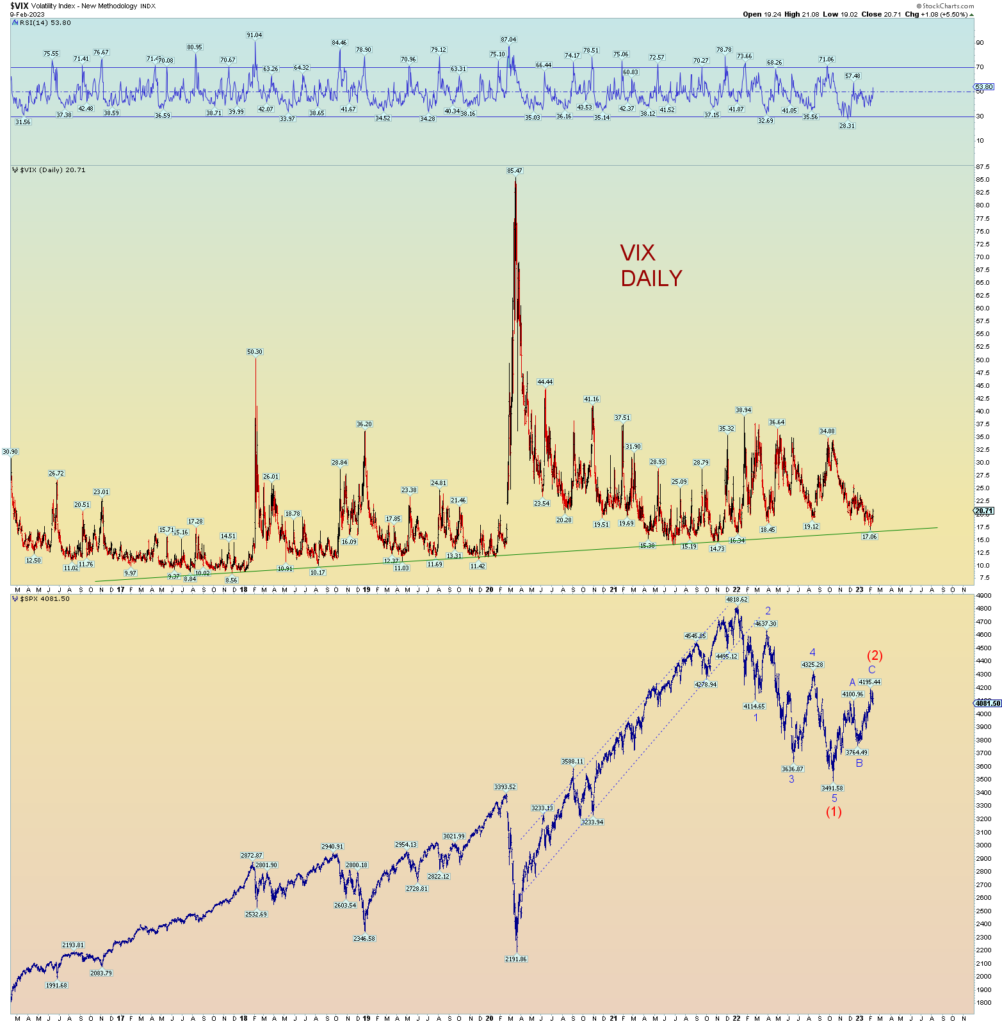

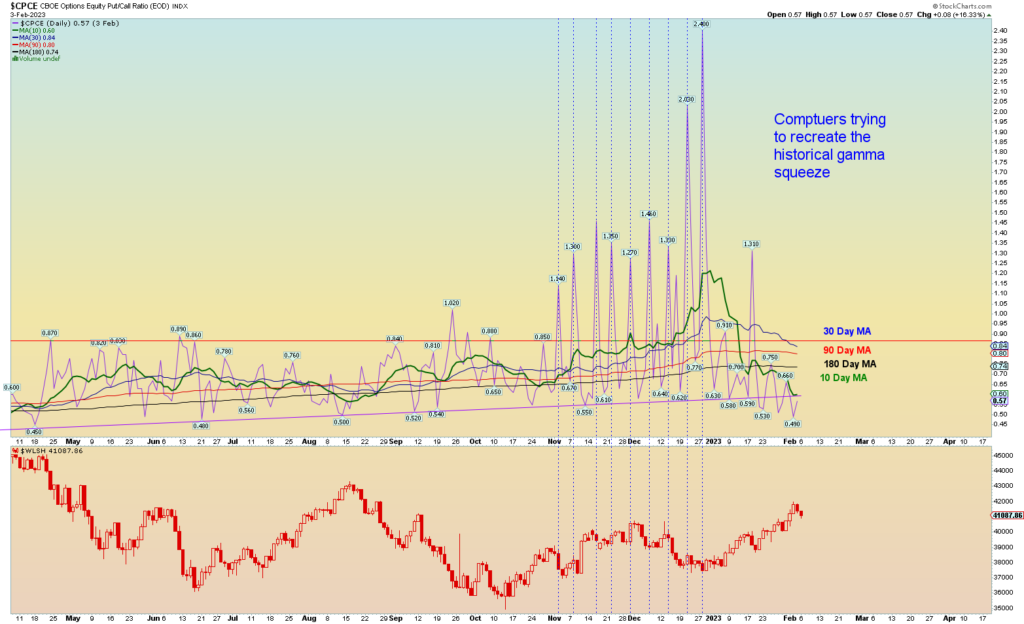

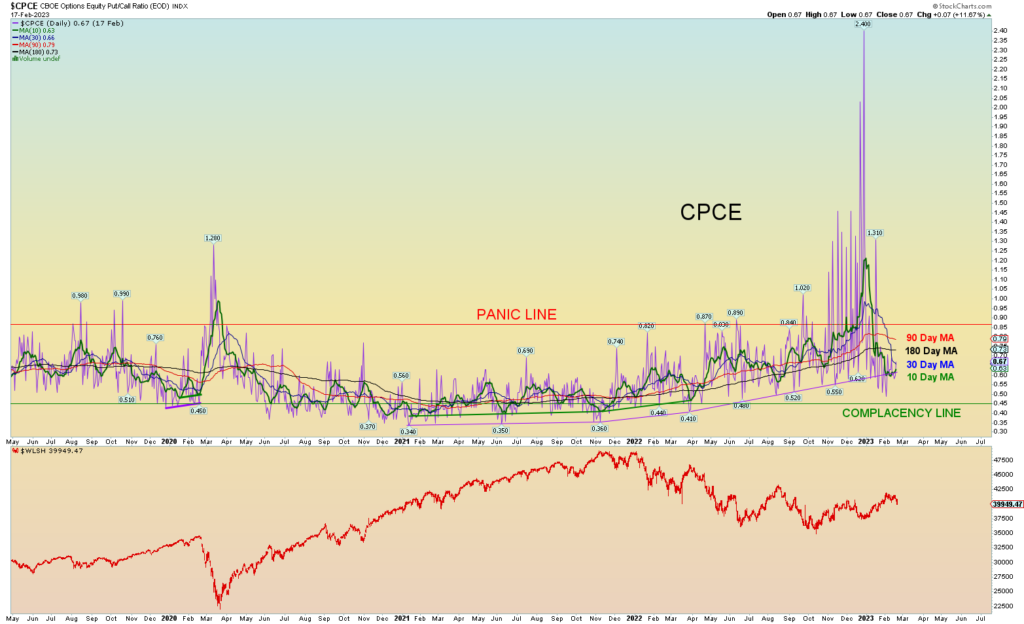

And why not? The excess bearsishness of the options markets has been thoroughly shaken out.

And remember, if the world is ending with the globalists making their final play to implement the New World Order, Satan is in a hurry to speed things up. We have the potential Antichrist threatening China. This is something an all-powerful Antichrist would be expected to do.

I have said off and on, that Putin, and even Xi are probably “in on it” being globalists of the WEF kind. Xi too will start a war to break his own countrymen and their willpower to resist. Afterall, isn’t that what China did with the hideous lockdowns and besides they are led by devils the communists are actually Zionists anyway. This seems to be what Putin is doing also. He is not interested in anything else but wrecking his country. Isn’t that what all the leaders of the world seem to be doing including in America? Making their own populations miserable and overbearing? And Trump? He is the bloodiest Zionist of them all!

The Russian and Chinese militaries (and populations) are the last 2 pieces of the NWO puzzle that must be “subdued”. Even if Putin and Xi aren’t part of the plan, and are legitimately fighting the Babylon USA and its partners, the bible says they will lose.

The Book of Daniel chapter 7 gives one key attribute of the Antichrist, he subdues 3 of the 10 final kings (the 10 end-times nations):

8 I considered the horns, and, behold, there came up among them another little horn, before whom there were three of the first horns plucked up by the roots: and, behold, in this horn were eyes like the eyes of man, and a mouth speaking great things.

The “little horn” in verse 8 above is the Antichrist. The 10 final nations are the 10 nuclear weapon nations of which there is 9 and Iran will be the 10th. (USA, UK, France, Russia, China, North Korea, Pakistan, India, Israel) Three of these nations must be “subdued” and that is in the works as we speak. Russia and China are clearly 2 of the 3. The third is likely Israel itself when the Antichrist comes to power (because they brought him to power) he may just well stab them in the back after he is assassinated and comes back to life 3 days later claiming to be Messiah and probably claiming to be Jesus. The Jews hate Jesus. But that is getting ahead of myself…

19 Then I would know the truth of the fourth beast, which was diverse from all the others, exceeding dreadful, whose teeth were of iron, and his nails of brass; which devoured, brake in pieces, and stamped the residue with his feet;

20 And of the ten horns that were in his head, and of the other which came up, and before whom three fell; even of that horn that had eyes, and a mouth that spake very great things, whose look was more stout than his fellows.

Again, verse 20 above reiterating that the little horn will subdue three of the 10 kingdoms in his rise to total power. Verse 21 below, once the Jew has total world power given to him by all the wicked leadership of the nations of the earth, the Antichrist will implement the mark of the beast made to “weed out” truly saved Christians and have them killed. That is Satan’s ultimate goal is to kill all Christians so that he is the only one left to be worshiped.

21 I beheld, and the same horn made war with the saints, and prevailed against them;

Verse 22 below is the First Resurrection/Rapture that takes place about 75 days after the abominations of desolations.

22 Until the Ancient of days came, and judgment was given to the saints of the most High; and the time came that the saints possessed the kingdom.

23 Thus he said, The fourth beast shall be the fourth kingdom upon earth, which shall be diverse from all kingdoms, and shall devour the whole earth, and shall tread it down, and break it in pieces.

Again verse 23 and 24 explain again what is going on with the 10 kings and the “other” that shall arise (Antichrist). He shall subdue 3 kings.

24 And the ten horns out of this kingdom are ten kings that shall arise: and another shall rise after them; and he shall be diverse from the first, and he shall subdue three kings.

In verse 25, The Antichrist will wear out the saints and his kingdom will last 42 months. But Jesus comes back to cut that time short for Christians at the rapture or no flesh would be saved.

25 And he shall speak great words against the most High, and shall wear out the saints of the most High, and think to change times and laws: and they shall be given into his hand until a time and times and the dividing of time.

26 But the judgment shall sit, and they shall take away his dominion, to consume and to destroy it unto the end.

27 And the kingdom and dominion, and the greatness of the kingdom under the whole heaven, shall be given to the people of the saints of the most High, whose kingdom is an everlasting kingdom, and all dominions shall serve and obey him.

This meshes perfectly with what Revelation says also. And the Antichrist will be Jewish. Zelenskyy is Jewish, he is outside the 10 nations, and he is trying to subdue the 1st of 3 and is threatening tanks in Moscow and threatens China. Is this weirdly coincidental or what? No because the King James bible is the word of truth.

If he ain’t the actual Antichrist, then it sure is a foreshadow of things to come.

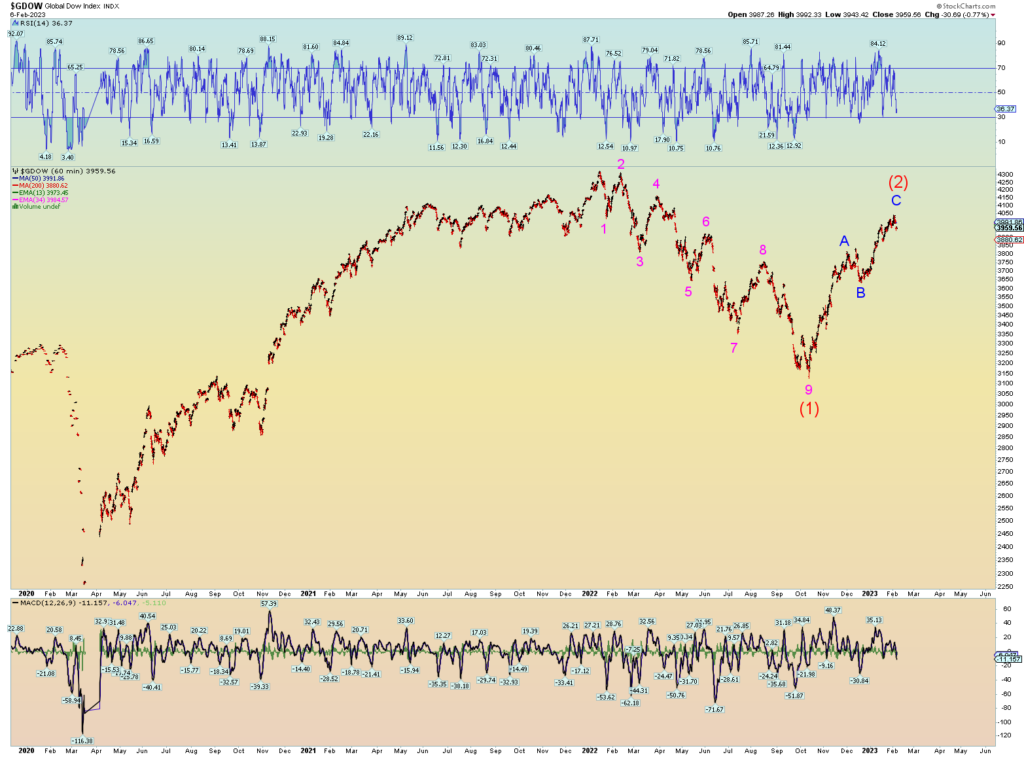

The best count has wave (2) finishing at C. The alternate is shown, but today’s terrible market internals don’t really support that view any longer.

Excess bearishness was alleviated, and greediness was back in vogue. This is what happens on a wave (2).

Junk being dumped just more evidence the poop may be about to hit the fan.