[UPDATE 15:08 EST] Looks like the market is determined to inflict as much pain on bears as possible. Squiggle count updated. The 1.618 Fib target resides at 4152 on the SPX.

[UPDATE 12:30 EST] IF this is nearing the top of (iii), then expect some afternoon weakness. An ideal retrace for (iv) is the gap area from this morning.

[UPDATE 12:11 EST] The Wilshire 5000 has reached a perfect wave (iii) = 1.618 times the length of wave (i). We may have reached the top of wave (iii).

[UPDATE 12:05 EST] I added a Fibonacci grid to show where wave (iii) is 1.618 times the length of wave (i) and that is at about 4152 SPX.

[UPDATE 12:02 EST]

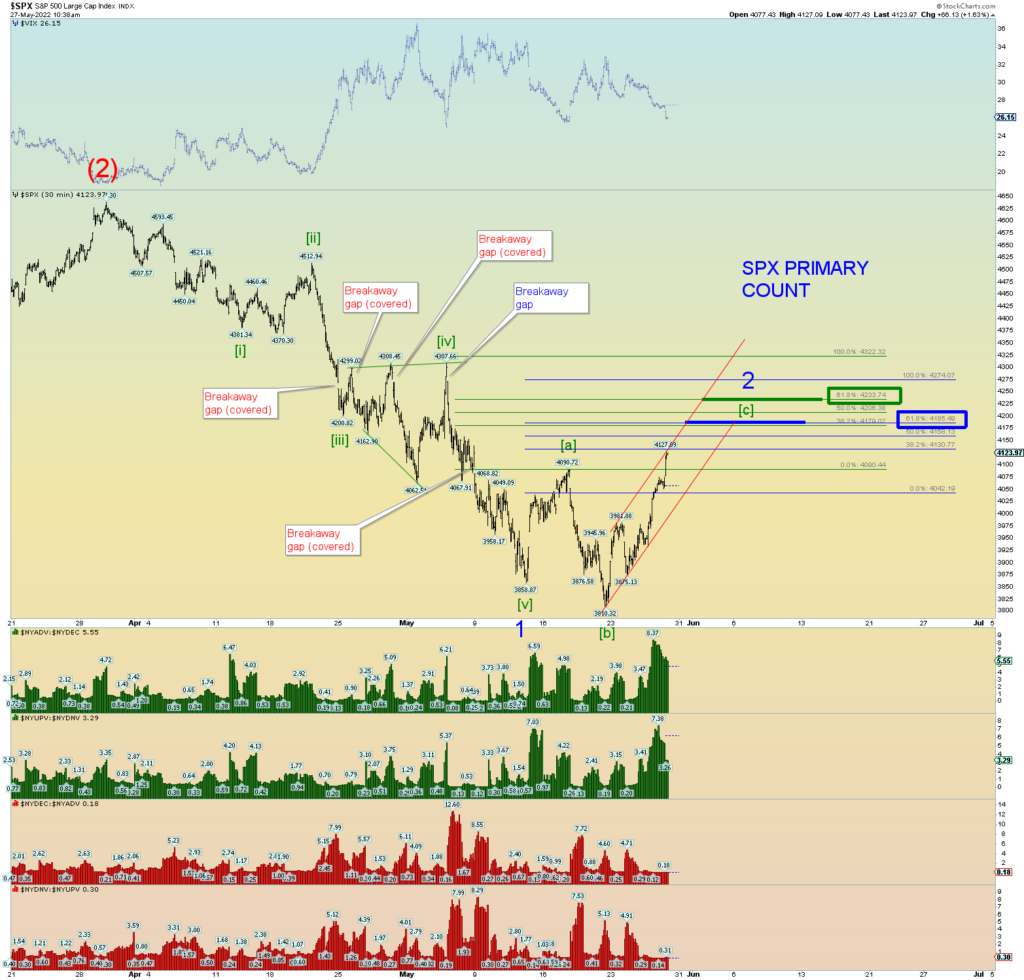

Total retrace and target area of Minor 2 in the SPX. Basically a challenge to its 50 DMA

[UPDATE 11:55 EST] When is it appropriate to make a 1-minute squiggle SPX chart? When it has moved 300+ handles in the span of 5 days…

[UPDATE 11:38 EST] Updated SPX chart. The best count has us looking for the top of Minuette (iii).

I made a nice SPX 5-minute chart to track wave ratio relationship targets of the proposed Minor wave 2 expanded flat count. Best guess squiggle count below. We can adjust as more waves unfolds. Keep an eye on the wave relationship target for wave (iii) of [c] of 2.