Yes, you can get saved by watching and hearing the Word of God on the internets.

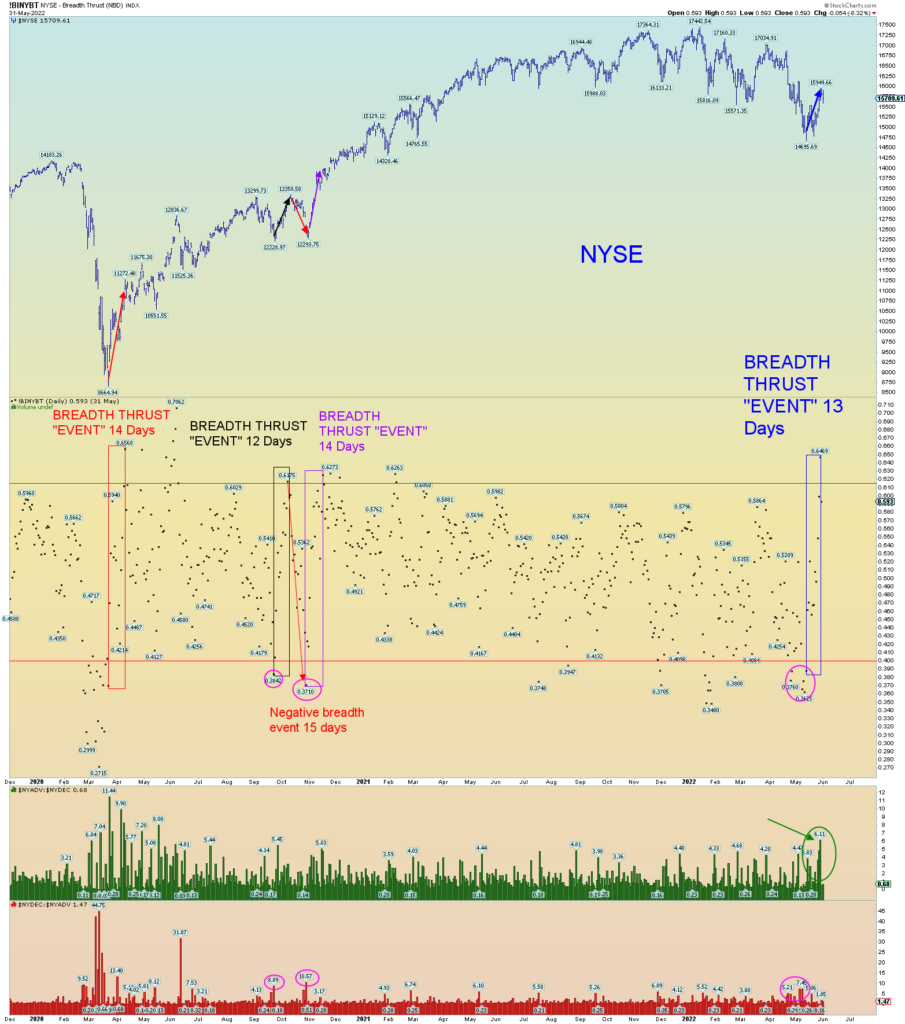

Looking at the NYSE “breadth thrust” indicator, we have had an “event” triggering last Friday. This is not an official “Zweig” event of 10 days or less however I consider a significant event nonetheless.

The primary wave count has the market topping in Minor 2 of (3). After this, more intense selling of what has occurred previously since the November Wilshire 5000 high should occur. And I’m counting on a “negative” thrust event which negates the recent positive and buries the daily print back beneath .40 on the scale. This would take a “close” beneath the closing price of Minor 1 of (3) low.

IF the market cannot pick up selling pressure to negate this positive event, then we might be faced with the “rare” extension of 2.618 for wave [c] of Minor 2 expanded flat. That would be the black hash mark on the downslope line.

But that is getting ahead of things as the market has yet to even reach our preferred Minor 2 target range (on the SPX its 4185 – 4233). I only point this out because this is my thinking about this positive breadth event which cannot be ignored until it is closed under and reversed. The primary wave count suggests that will happen, but the market doesn’t always go the path we wish it to take.

At the very least, we can now determine probably where wave (iii) of 2 peak is and likely the price low of (iv) of 2.

The SPX rose over 9% in a tad of 5 trading days so it was a significant move. For now.