In our simplified EW count of the SPX, the count allows for another small wave higher. It doesn’t have to happen there are enough waves in place. Additionally, the “time and price” factor of Minor wave 2 retrace is ideal as it is.

Back when Minor 2 was first developing, the count allowed for time and price as this chart from a month ago suggests spx60-9.png (1565×1464) (danericselliottwaves.org)

The 61.% Fib (from Intermediate wave (2) peak) and Veterans Day of the 11th give or take a few days seemed doable. And so, it has. We have double Fib resistance along with SPX 4000 resistance. It seems a “foregone” conclusion that the SPX will close that massive open chart gap down that lies just above, but sometimes if that’s what everyone expects, then the opposite happens. Or at least the pathing to get there is not a direct route.

Despite what others are saying, last week was not a “breadth event” as I like to say. In fact, last Friday’s data shows divergence and I don’t have today’s data, but it will show even more divergence tomorrow. Basically, today could have been Minor 2 high occurring on decent negative breadth day.

JUNK is lagging. Still a risk-averse market.

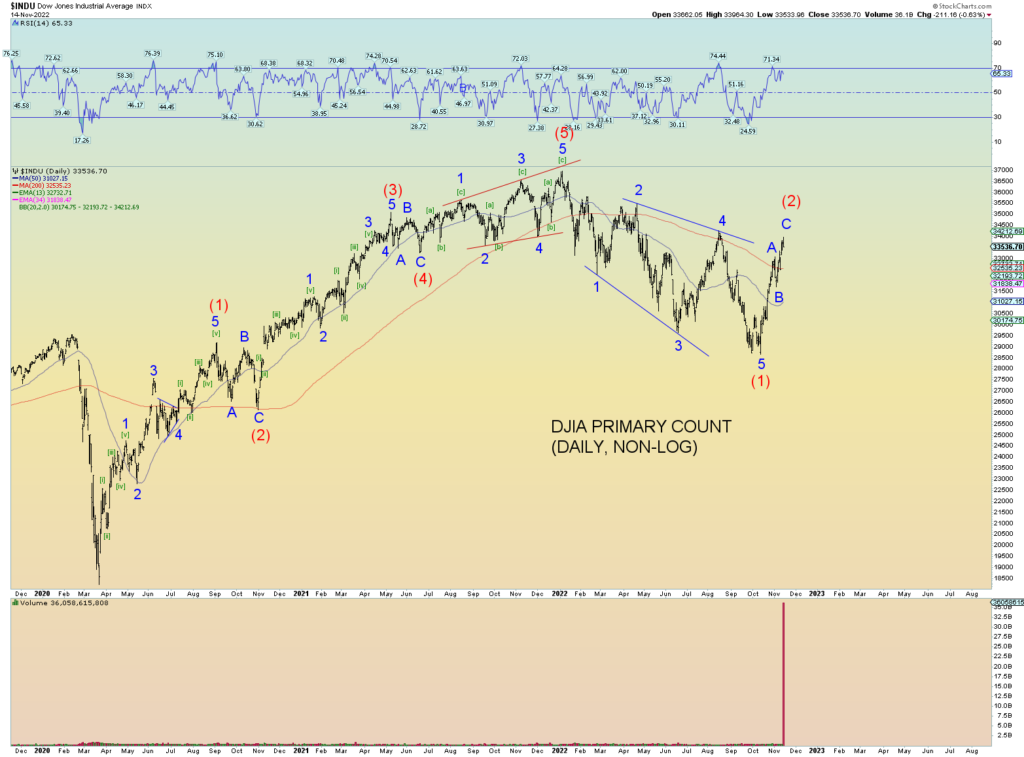

The DJIA is trying to mask the overall rot that exists underneath on the market as a whole. The size of the waves is huge compared to what came before. In my estimation a huge beginning set of waves to a bear market could indicate that the overall collapse will be prolonged and deep. And of course, I am predicting the end of the world as we know so yeah, there ya go.