The primary count is that Minute [i] of Minor wave 3 of Intermediate wave (3) down has reached its price low in today’s SPX low of about 3903.

Therefore Minute {ii] up will commence and it could be yet another market-inducing vomit that squeezes higher in low volume based on market mechanics.

A solid break of wave “A” which means the rise to (2) was indeed “corrective” 3 waves overall: A, B, C.

This seems the best squiggle count for now and assumes a temporary low is in place. I ran out of chart room for wave [ii], so don’t assume wave [ii] occurs that fast in time.

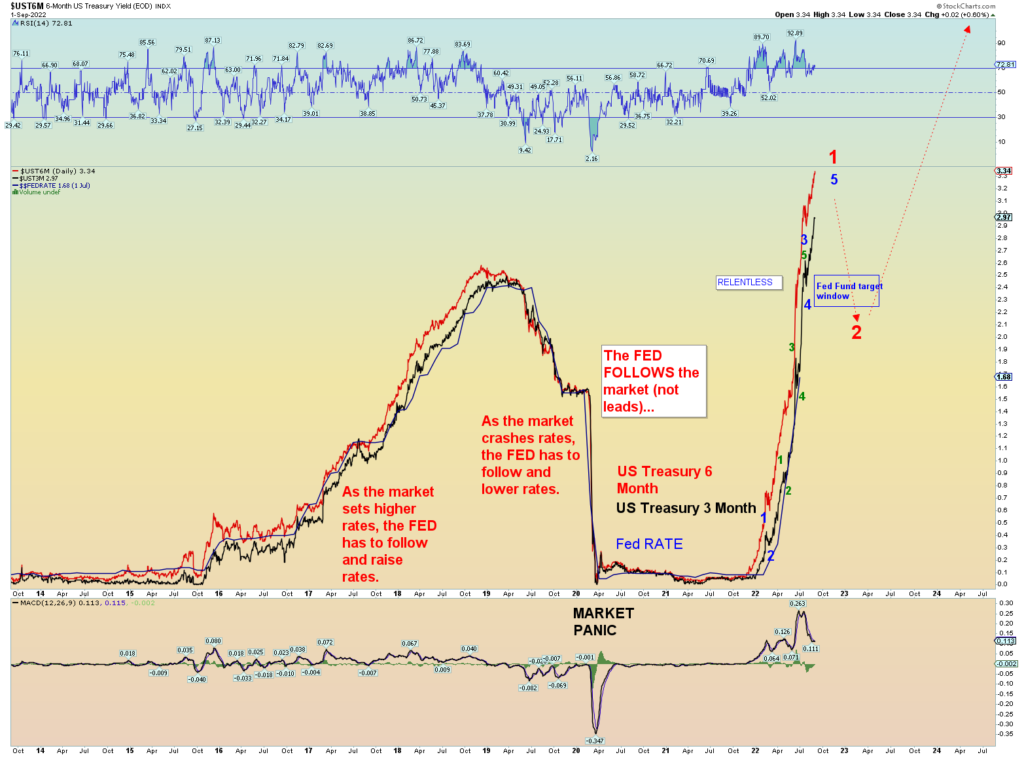

The wave count on the 3 month note suggests the rise in yields will lose momentum in a first wave peak. Then a pullback which may result in the Fed reducing rates for a little bit and then acceleration to higher rates than what was experienced in the early 1980’s. The financial system survived in the time of Volker because it was not yet leveraged 100-1 like it is now.