We are still looking to confirm Minute [i] of Minor 1 of Intermediate wave (3) down. That is the best count for now. Trying to predict bounce waves in a wave (3) down could be a futile effort. But still, that’s why we count squiggles. This wave structures seems more fleshed out than the count from last week. If so, wave (v) of [i] should finish tomorrow.

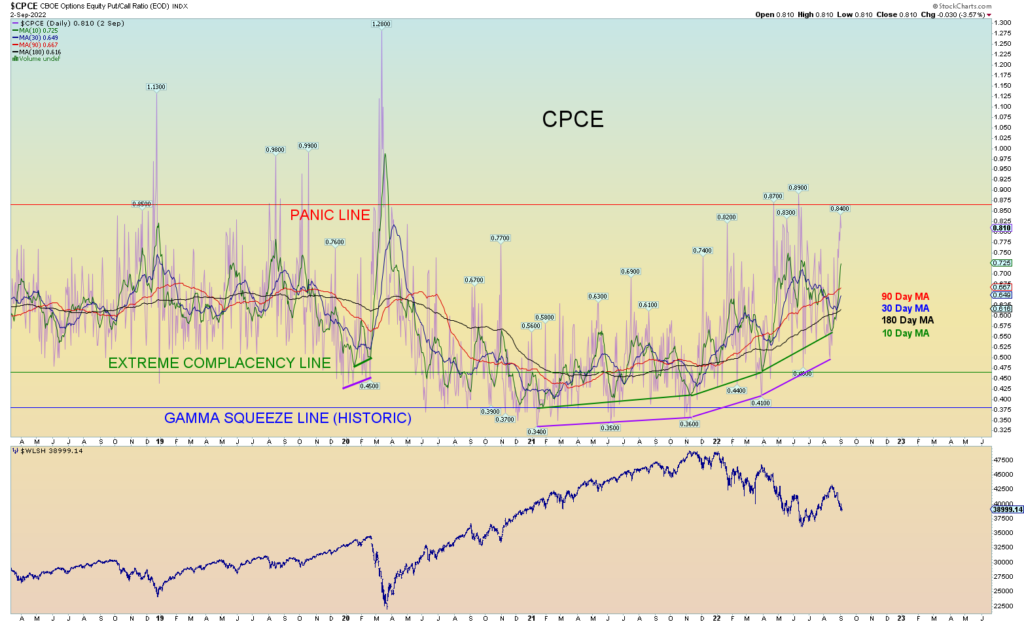

Sentiment is strange at the moment. It sort of feels the same as just before the Russia/Ukraine war. And then when it happened on February 24th, the market plunged, closed much higher, and went on to rally in Minor wave 2 of (1). Could be a similar setup, “bad news” happens, market plunges to form Minute [i] low and then a sharp rally that retraces a decent portion of the recent pivot top, but eventually dies out because there are still plenty people who will want out of this market even at marginally higher prices from here.

If the above is the scenario, Minute wave [iii] of Minor 1 of (3) will be a more intense selling wave. A bit of a “panic” wave.

Anyways, just a thought I had. Isn’t the stock market fun?

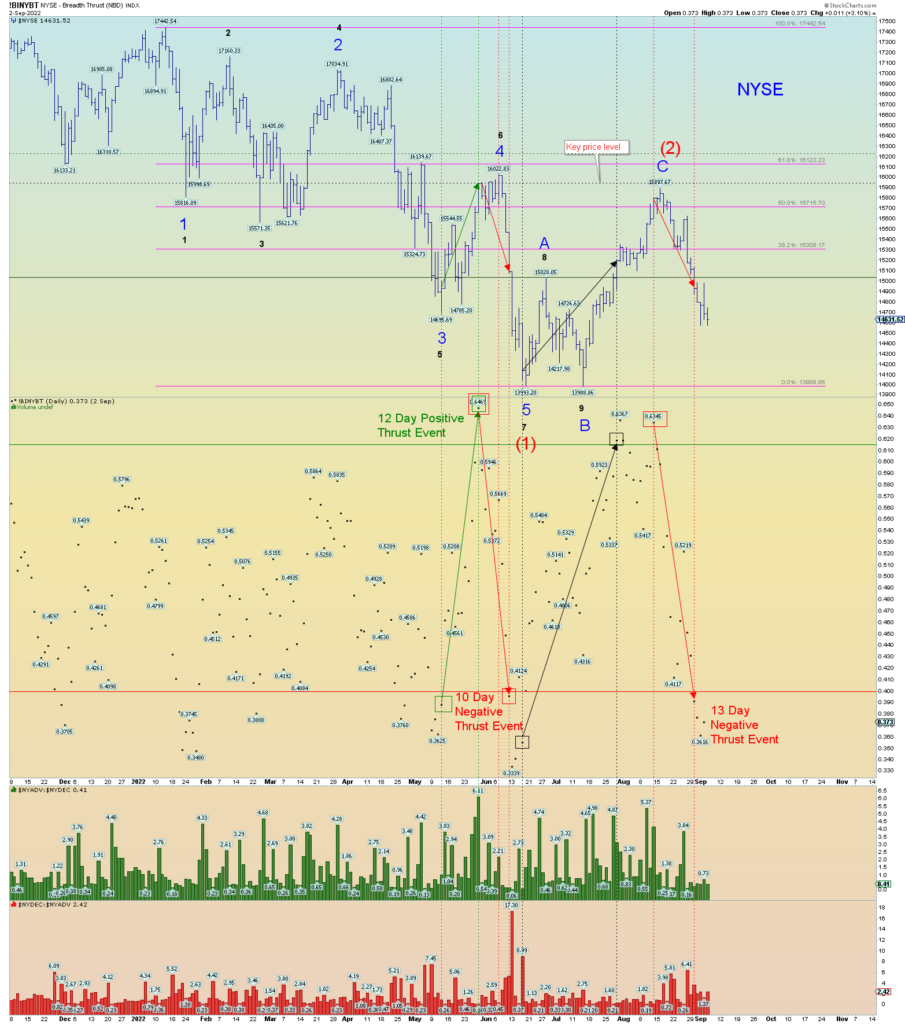

The decline so far since (2) has been sharper than the rise to (2). Helps give credence that the count is (3) down overall. Remember, the objective of Minor 1 of (3) is to advance prices lower than (1). And since this is projected to be a very harsh bear market, prices could be significantly lower. This is the reason to look for the first subwaves [i] and [ii] of 1.

I was trusting that the internal market data of the NYSE, would prevail and it has certainly so far. After the 10-day very rare negative thrust event, the 30+ day effort to climb higher fizzled out and selling took over near the same spot and producing a 13-day negative event, which is another strong signal that helps reinforce the first negative event.

Regardless it’s a herky-jerky market. These are not small waves…