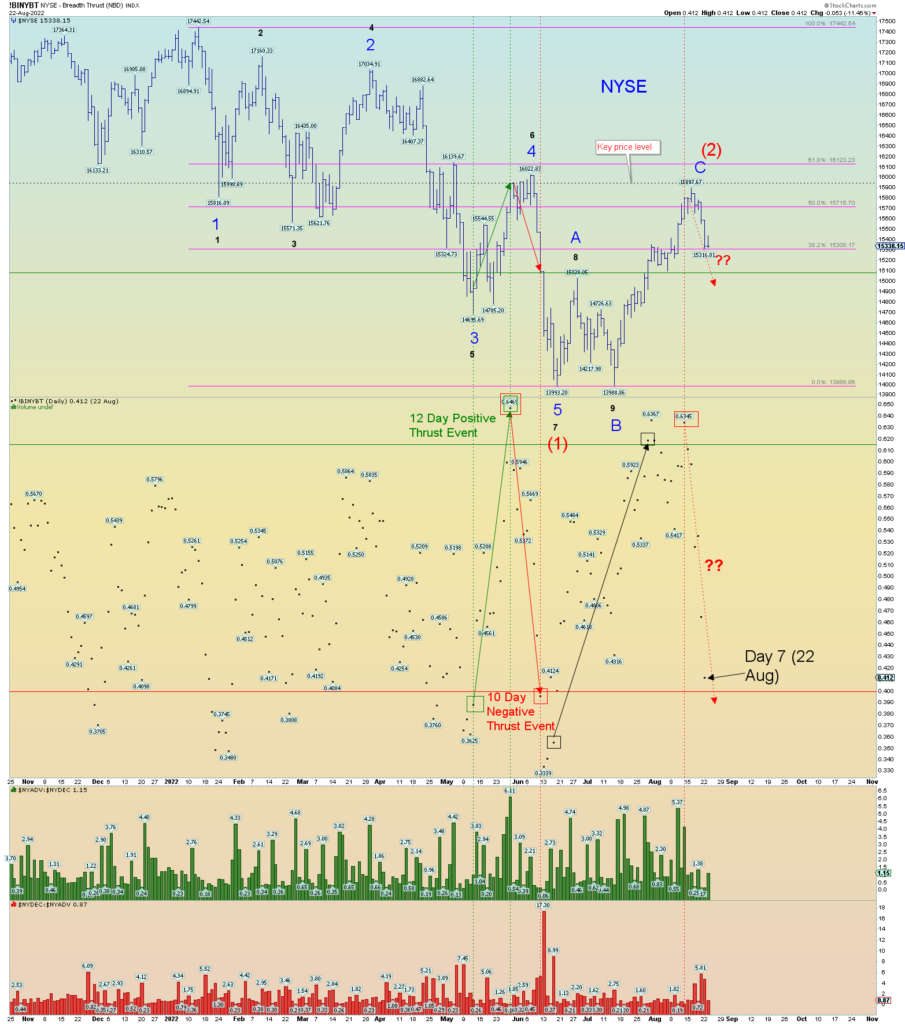

Yesterday’s NYSE breadth thrust data. The market is like a yo-yo. Although I don’t have today’s data, today was not likely to push this indicator below .40. Today would be “day 8”. If breadth plunges beneath .40 line in the next 2 days, we will have had 2 very rare negative Zweig Breadth Thrust events. And yes, I know that is not really a thing, but I can make my own rules.

This is happening at the same price level as the one prior in late May/early June just as I predicted a few weeks back in this detailed post here on 28 July.

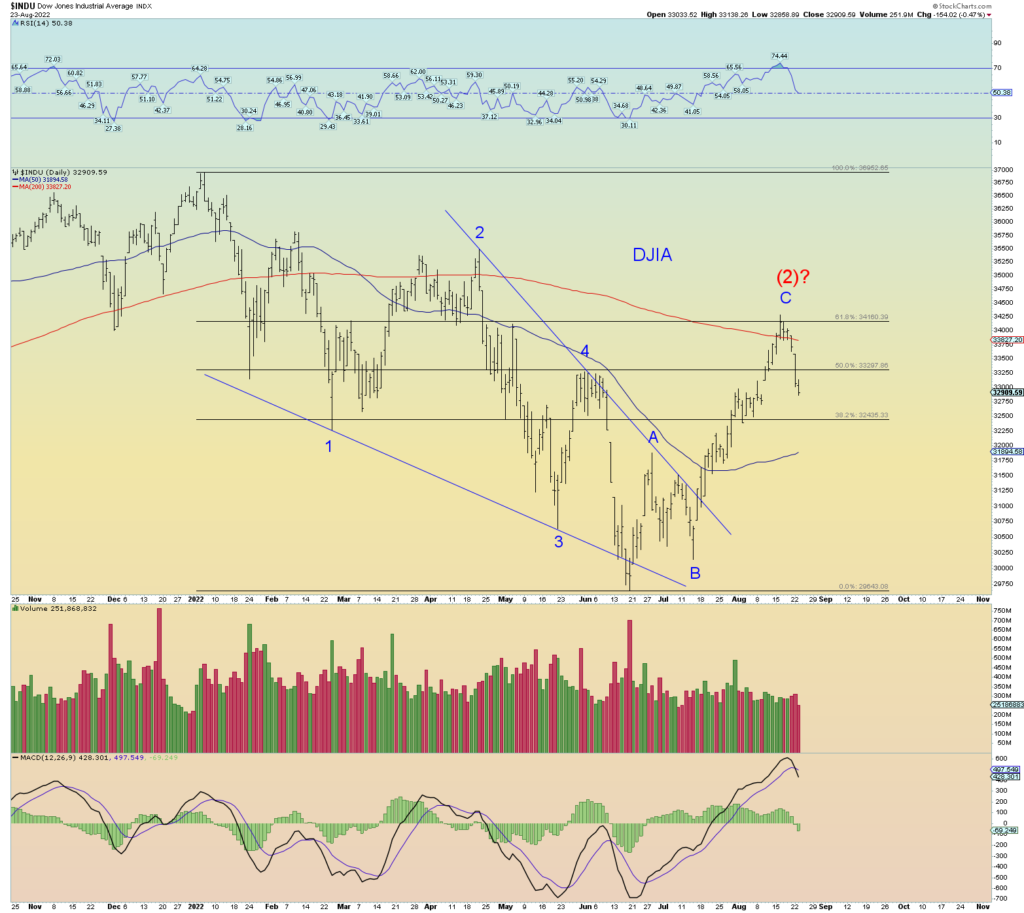

The best squiggle count has the market nearing Minute [i] perhaps. I’m still counting on a decent down day over the next 2 days to trigger another inverse Zweig event.